Affordability could hit historic levels

In this quick speed read, we look at affordability as interest rates rise!

- Significant rises to mortgage interest rates will mean fewer first time buyers able to get on the housing ladder. New borrowers won’t have the luxury of existing low rates.

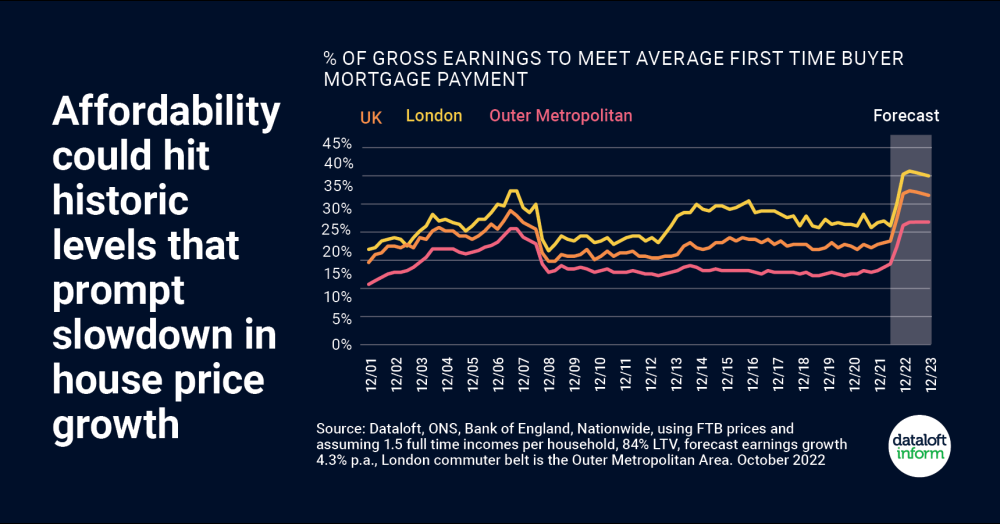

- We tracked ‘affordability’ over the past 20 years – based on the proportion of gross income needed to meet mortgage payments. Interest rate rises drive up monthly payments.

- While it is possible that interest rates will subside if the financial markets settle, it seems unlikely and the expected rise takes affordability to levels that normally trigger a slowdown in house price growth and transactions.

- In London, the average first time buyer will need another £500 pcm if mortgage rates rise to 6% as forecast. That comes on top of a similar increase earlier this year.

- Outside the more expensive parts of the UK housing market, there may be more headroom to afford interest rate increases.

- Source: Dataloft, ONS, Bank of England, Nationwide