After a subdued end to 2025, the first quarter of 2026 has quietly rebuilt confidence in the housing market. March may be the strategic launch point sellers have been waiting for.

Discover this superb modernised detached four-bedroom family home on Springfields, Attleborough, ideal for the centre of town. Boasting two reception rooms, two shower rooms, and a refitted kitchen, this home also includes a utility room, as well as a study/home office, and has a good size rear garden.

Take a 'Virtual Tour', Modernised 4-Bed Family Home, Well Presented and Ideal for the Centre of Town

Discover this superb modernised detached four-bedroom family home on Springfields, Attleborough, ideal for the centre of town. Boasting two reception rooms, two shower rooms, and a refitted kitchen, this home also includes a utility room, as well as a study/home office, and has a good size rear garden.

Take a 'Virtual Tour'Non Estate 4-Bed Det. Hse with Double Garage in the well served town of Hingham

Spacious and beautifully presented, this four double bedroom detached home offers modern family living in a pleasant non-estate location. Featuring an open-plan kitchen/diner, separate lounge and study, en suite to the main bedroom, and a double garage, all within a short walk from village amenities

Guide Price £300,000 to £325,000 - A superb three-double bedroom detached family house, ideally situated at the end of a quiet cul-de-sac. Boasting modern amenities, underfloor heating, and an en suite, it offers comfortable living within reasonable walking distance of the town centre.

An exceptional individual 4-bedroom detached family house, beautifully presented, set on a plot of just under third of an acre with a double garage. Featuring a superb 2-storey, 2-bedroom detached annexe with open plan living and delightful wrap-around gardens, this property offers versatile living.

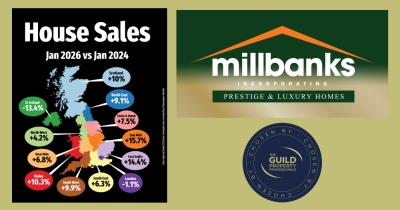

January 2026 showed a market regaining momentum. Across much of the UK, sales agreed are running ahead of two years ago, led by the Midlands and East. Scotland and Wales are also strengthening. London remains mixed, and Northern Ireland softer. This is not a boom, but a steady, broad based rebuild driven by realistic pricing.

In early 2023, forecasters warned of a steep UK housing slump, predicting falls of up to 15% after rising rates and political turmoil. Three years on, the data tells a calmer story. HM Land Registry shows prices nearly 4% higher nationally, with Attleborough steady. As 2026 begins, is crash talk fact or just headlines?

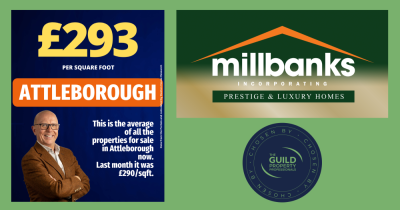

Welcome back to the latest insight into Attleborough’s property market. This month’s £ per square foot snapshot offers a fresh look at the market’s underlying rhythm. It reflects the mix of homes currently for sale rather than headline price swings. Curious how your property fits the picture? Let’s arrange a relaxed, no obligation chat.

If you are planning to sell in Attleborough, timing depends on more than luck. Property type, bedroom count, pricing and marketing all shape the outcome. Some homes attract swift interest, while others linger. Understanding local trends and launching at the right price from day one can make the difference between a smooth move and a stalled sale.

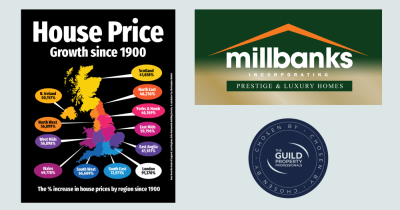

At first glance, UK house prices rising tens of thousands of per cent since 1900 look absurd. But annualised over 126 years, growth averages around 4.5 to 5 per cent a year. It is not sudden surges but steady compounding that drives values higher, showing property rewards time in the market more than attempts to time it.

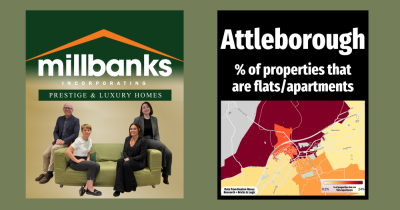

At first glance, Attleborough looks like any market town. Look closer and its housing tells a richer story. This map reveals where flats cluster near the centre and key routes, and where houses dominate the outskirts. From apartment pockets to house only estates, it shows that Attleborough is not one market, but several shaped by property type.