Are we making the most of the space we live in? In towns like Attleborough and across the UK, millions of homes boast two or more unused bedrooms—a surprising reality that cuts to the heart of the country’s housing debate. With 8.9 million properties sitting on excess space, it’s time to ask: are we using our homes as wisely as we think?

In towns like Attleborough, the number of homes with two or more spare bedrooms is striking. Across the UK, 8.9 million homes have this level of extra space—an eye-watering statistic when considering the ongoing housing crisis and the demand for family homes.

It’s a sensitive subject. Many of these larger homes belong to an older generation who have lived in them for decades, raising families before finding themselves with empty rooms. These properties were built in an era when bedrooms were more generously sized than the modern equivalents, making them highly desirable. However, for some, the rising cost of maintaining and heating such properties is becoming a challenge, especially for those on fixed incomes.

Yet, the idea of ‘downsizing’ often sparks strong emotions. A home is more than bricks and mortar—it’s memories, stability, and a reflection of a lifetime’s work. Encouraging homeowners to move isn’t straightforward, nor should it be. People have the right to make their own choices about where they live.

However, the data does raise important questions about how we use housing stock. In a town like Attleborough, where families are searching for larger homes, the availability of suitable properties is crucial. If those who no longer need the space could access appealing, well-located alternatives, it might help unlock movement in the market. The issue though there is lack of suitable bungalows in the UK!

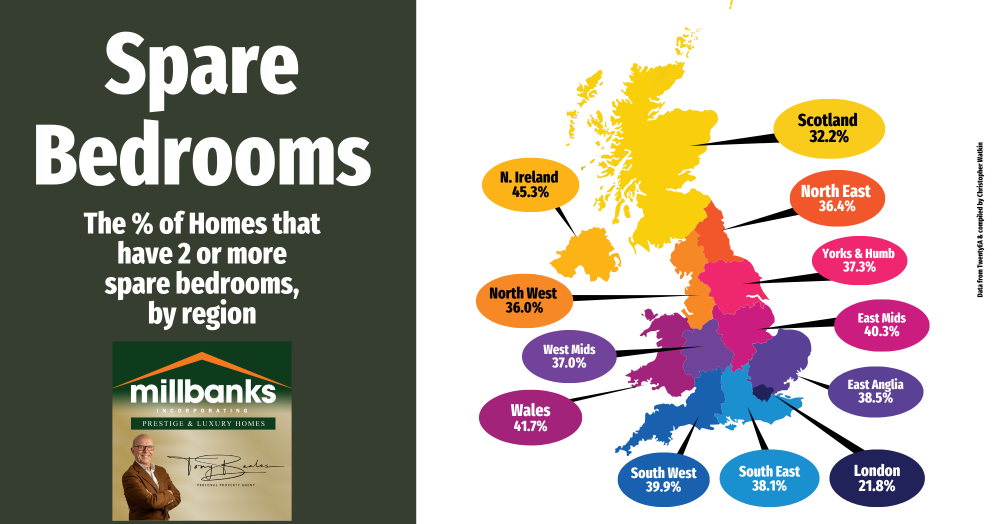

Looking at the numbers, the percentage of homes with two or more spare bedrooms varies significantly by region:

- Northern Ireland – 45.3%

- Wales – 41.7%

- East Midlands – 40.3%

- South West – 39.9%

- South East – 38.1%

- East Anglia – 38.5%

- Yorkshire & Humber – 37.3%

- West Midlands – 37.0%

- North East – 36.4%

- North West – 36.0%

- Scotland – 32.2%

- London – 21.8%

Ultimately, property decisions are deeply personal. But for those considering a move, knowing the demand for larger Attleborough homes is there may help make that decision a little easier

If you're a homeowner in Attleborough and considering your next move in the next 6–12 months, why not pick my brain about the local property market? Whether you're curious about house prices, demand, or just want to chat about your options, give me a call on (01953) 453838 or drop me an email to tony@millbanks.com

You might be surprised at what’s happening in Attleborough right now!