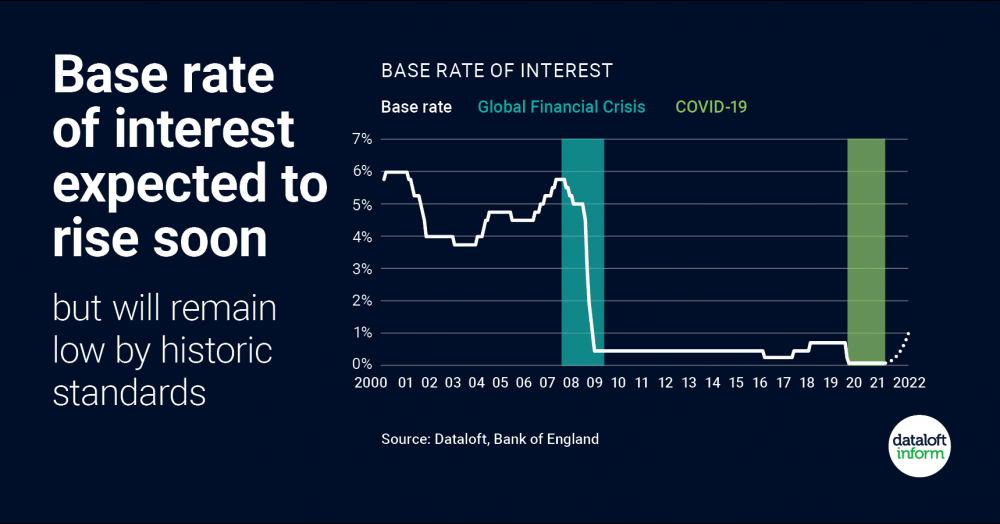

Base rate of interest expected to rise soon

In this speed read, we take a look at the potential for an interest rate rise in the coming months

- The base rate of interest is set to rise in the 'coming months' as the Bank of England acts to control the UK economy.

- The Bank voted to keep the base rate at its historic low of 0.1% in November, but with inflation 3.1% and predicted to rise to as much as 5% in the first half of 2022, a rise is likely.

- Any rise will impact mortgage borrowing costs, although with an estimated 80% of borrowers on fixed rate deals, no significant adjustment to the housing market is anticipated in the short term.

- Compared to the Global Financial Crisis in 2008/09, when the base rate was often in excess of 5%, the rate by the end of 2022 is expected to be a maximum of 1%.

- Raising the base rate encourages people to save, not spend,. This should slow the increase in prices of household goods.

- Source: Dataloft, Bank of England