In recent years, the European residential mortgage market has experienced significant fluctuations, reflecting broader economic trends and local housing dynamics.

In recent years, the European residential mortgage market has experienced significant fluctuations, reflecting broader economic trends and local housing dynamics. By examining both the total mortgage lending and the average lending per capita from 2019 to 2023, we gain a deeper understanding of the property market's impact on individual citizens and the overall economy of each country.

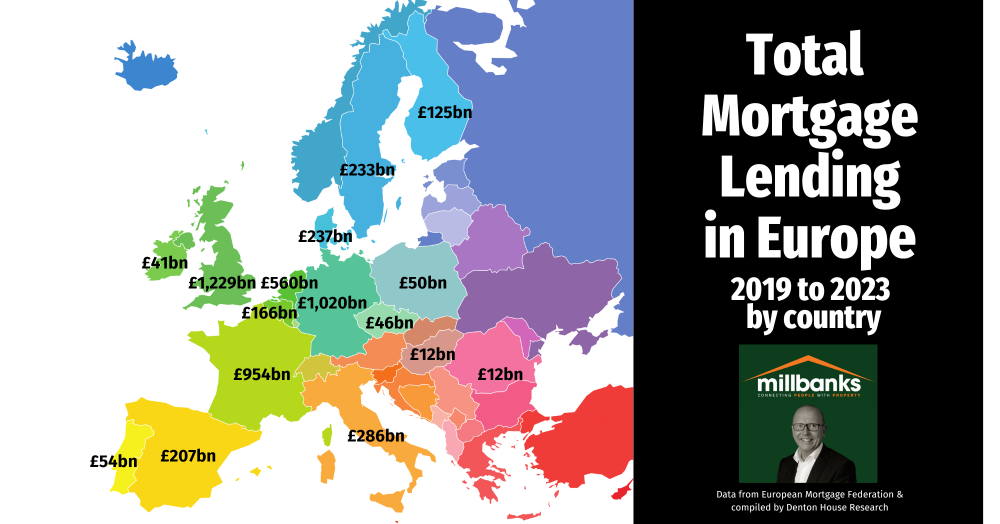

Total Mortgage Lending in Europe

Between 2019 and 2023, the United Kingdom led the way with an impressive £1,229 billion in gross residential mortgage lending. Germany followed closely with £1,020 billion, demonstrating its robust housing market. France also showed strong performance with £954 billion, while the Netherlands contributed £560 billion to the European total.

Italy, despite its economic challenges, managed a respectable £286 billion, highlighting resilient demand for homeownership. The Nordic countries of Sweden (£233 billion) and Denmark (£237 billion) continue to benefit from their stable economies and high living standards. Spain, recovering from earlier financial crises, posted £207 billion, indicating renewed confidence in its housing market. Belgium (£166 billion) and Finland (£125 billion) also reported steady mortgage lending figures, reflecting their stable housing markets.

In Eastern Europe, Poland (£50 billion) and Czechia (£46 billion) showed promising growth, while Portugal (£54 billion) and Ireland (£41 billion) demonstrated steady market conditions. Hungary and Romania, both with £12 billion, are emerging markets, indicating potential for future growth.

Average Mortgage Lending Per Capita

By examining the average mortgage lending per person, we can gain a clearer picture of how these figures translate to individual financial engagements within each country. Here’s a detailed breakdown:

- United Kingdom

- Total Mortgage Lending: £1,229 billion

- Population: 67 million

- Average per person: £18,358

- Germany

- Total Mortgage Lending: £1,020 billion

- Population: 83 million

- Average per person: £12,289

- France

- Total Mortgage Lending: £954 billion

- Population: 65 million

- Average per person: £14,677

- Netherlands

- Total Mortgage Lending: £560 billion

- Population: 17 million

- Average per person: £32,941

- Italy

- Total Mortgage Lending: £286 billion

- Population: 60 million

- Average per person: £4,767

- Sweden

- Total Mortgage Lending: £233 billion

- Population: 10 million

- Average per person: £23,300

- Denmark

- Total Mortgage Lending: £237 billion

- Population: 6 million

- Average per person: £39,500

- Spain

- Total Mortgage Lending: £207 billion

- Population: 47 million

- Average per person: £4,404

- Belgium

- Total Mortgage Lending: £166 billion

- Population: 11 million

- Average per person: £15,091

- Finland

- Total Mortgage Lending: £125 billion

- Population: 5.5 million

- Average per person: £22,727

- Poland

- Total Mortgage Lending: £50 billion

- Population: 38 million

- Average per person: £1,316

- Czechia

- Total Mortgage Lending: £46 billion

- Population: 10.5 million

- Average per person: £4,381

- Portugal

- Total Mortgage Lending: £54 billion

- Population: 10 million

- Average per person: £5,400

- Ireland

- Total Mortgage Lending: £41 billion

- Population: 5 million

- Average per person: £8,200

- Hungary

- Total Mortgage Lending: £12 billion

- Population: 9.6 million

- Average per person: £1,250

- Romania

- Total Mortgage Lending: £12 billion

- Population: 19 million

- Average per person: £632

Key Insights and Trends

High Per Capita Lending in Denmark and the Netherlands

Denmark stands out with a very high £39,500 per person, the highest among the analysed countries, indicating a highly active mortgage market relative to its population size. The Netherlands also shows a substantial average of £32,941 per person, underscoring the country's high property values.

Significant Engagement in the UK and Nordic Countries

With an average of £18,358 per person, the UK's leading position in total mortgage lending is also reflected in its high per capita figure, signifying widespread mortgage engagement among its population. Sweden (£23,300) and Finland (£22,727) maintain high per capita lending figures, reflecting robust mortgage markets in these Nordic countries.

Germany and France: Large Markets with Lower Per Capita

Germany and France, while having high total mortgage lending, show lower per capita figures (£12,289 and £14,677, respectively), reflecting their larger populations. This indicates strong overall market activity but relatively moderate individual mortgage engagements.

Emerging Eastern European Markets

Countries like Poland (£1,316) and Romania (£632) show emerging market potential with lower averages. These figures highlight the growing mortgage markets in Eastern Europe, driven by improving economic conditions and increasing homeownership.

Resilient Southern Europe

Italy (£4,767 per person) and Spain (£4,404 per person) exhibit moderate per capita lending, reflecting their resilient housing markets despite economic challenges. Portugal (£5,400) and Ireland (£8,200) maintain steady market conditions, indicating stabilisation following previous financial crises.

Conclusion

The European residential mortgage market from 2019 to 2023 reveals a diverse and dynamic landscape. By combining total mortgage lending data with population figures, we uncover not only the scale of market activity but also the depth of mortgage engagement within each country. This comprehensive analysis provides valuable insights for estate agents, property market analysts, and stakeholders, offering a nuanced understanding of broader European housing trends and their impact on individual citizens.