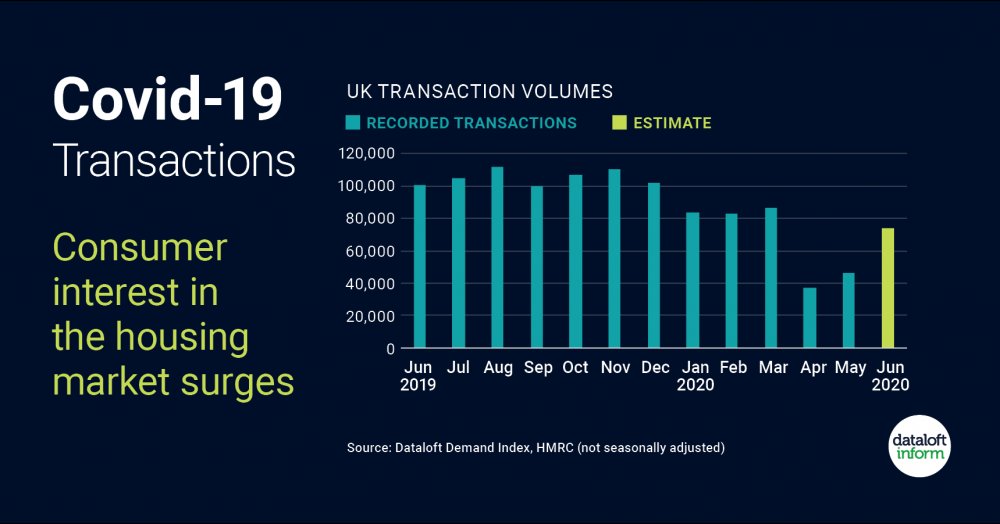

Covid-19 transactions by month.

- HMRC estimated 46,230 sales in May, 25% higher than April. With plenty of pre-lockdown sales still to complete and Dataloft Demand Index reporting a huge surge of consumer interest in the housing market, the total could rise by 60% in June.

- 9,250 sales exchanged per week in April when the UK was in lockdown. Assuming the same rate in the first three weeks of May (professionals not fully active in 3rd week), 18,480 sales would have exchanged in 4th week of May.

- We estimate 74,000 sales will exchange in June, the same weekly level as 4th week of May. In July we expect a greater increase, as the market picks up in Scotland and Wales, following opening end of June.

- Growth of unemployment, availability of higher Loan to Value products and government support, will play a huge role in the medium-term transaction volumes and prices achieved. Source: Dataloft Demand Index, HMRC (not seasonally adjusted)