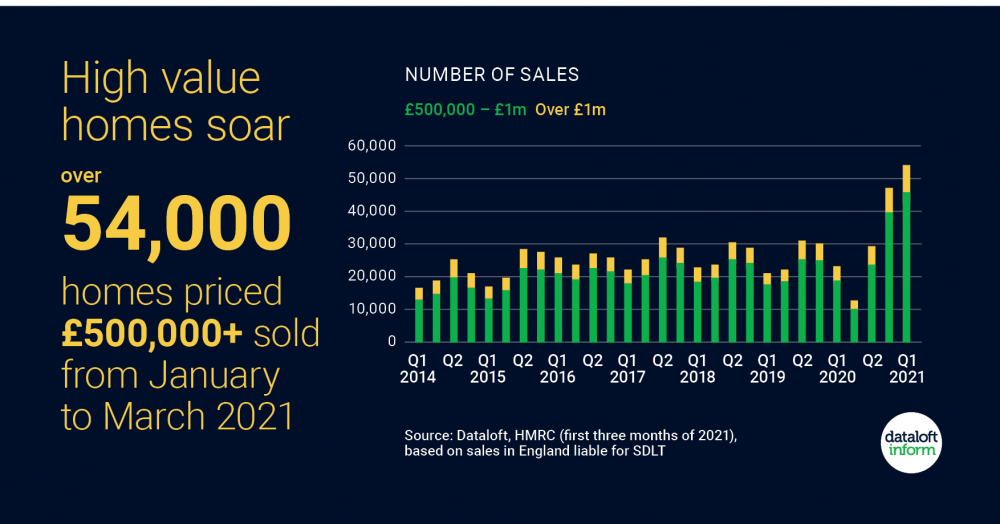

In this short article we take a quick look at the rise in property prices at the higher end of the market

- Data from the HMRC and the Welsh Revenues Authority indicate high value sales rocketed in the final three months of 2020 and into 2021, buyers saving money thanks to the Stamp Duty Holiday.

- Over 54,000 homes sold in England with a price tag in excess of £500,000 in the first three months of 2021, more than twice the average (based 2015-2019).

- In Wales more than 1,200 homes sold for over £400,000 during Q1, more than 560 properties in March alone (LTT, WRA).

- Top of the ladder properties are currently seeing the strongest level of price growth across the market according to Rightmove, such homes over £14,500 more expensive than 6 months ago. Source: Dataloft, HMRC (2021), based on sales in England liable for SDLT