House price forecast

Always a popular favourite amongst our followers predicting property growth

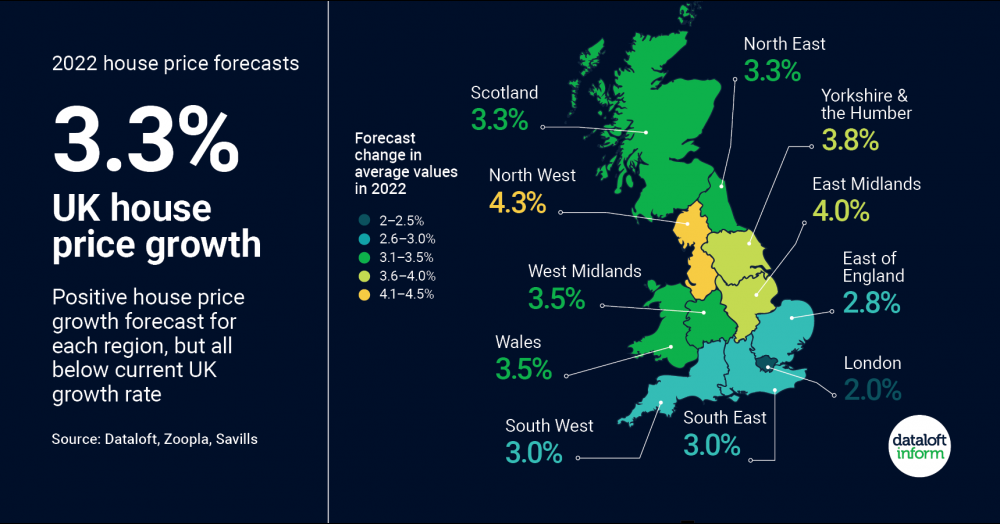

- The rate of house price growth is due to slow in 2022, but remain positive, ranging from 2% (London) to 4.3% (North West).

- Growth will be highest in northern and Midlands regions, where affordability is less constrained, and slowest in London where it is more stretched.

- A shortage of homes on the market and high levels of equity will be key drivers for house price growth in 2022.

- Cost of living rises and the expectation that mortgage rates and taxes will increase in 2022 are likely to impact affordability, thus limiting house price growth.

- Source: Dataloft, Zoopla, Savills