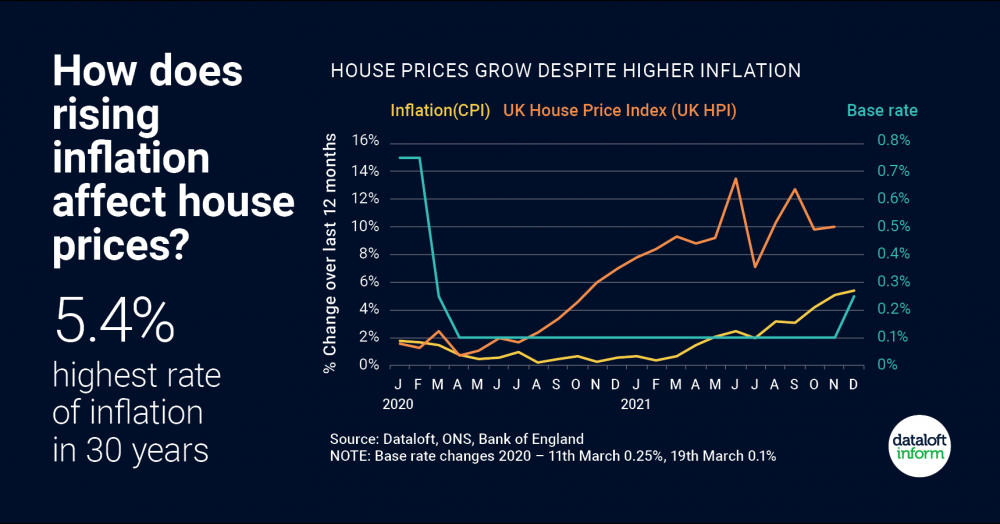

We take a quick look at how rising inflation can affect house prices

- Consumer price inflation (CPI) has risen to 5.4% in the 12 months to December 2021. This is the highest rate in 30 years, but is expected to fall back after an April peak (ONS).

- Energy costs are a major component of price rises and this is likely to turn the spotlight on energy efficient homes.

- The key driver of house prices and affordability is interest rates, which are expected to remain low in the long term, despite a small rise to 0.5% widely expected in February.

- Other drivers of demand, which are expected to continue, are lifestyle changes and deposits saved during the pandemic.

- Source: Dataloft, ONS, Bank of England