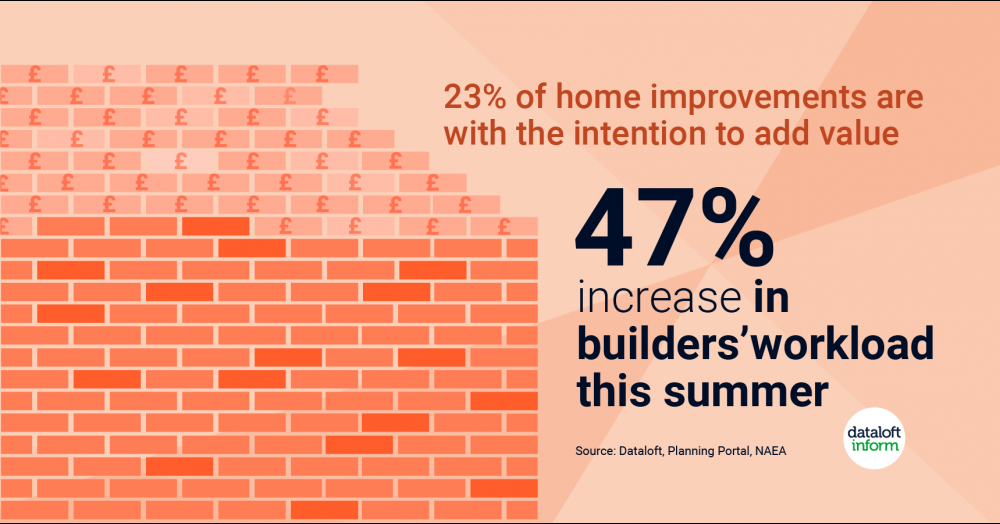

In this quick article we look at the increase in builders work load and the increase in planning applications since the summer. Please click or tap the picture to find out more

- People have spent an increased amount of time at home this year encouraging home improvements. Builders have seen a 47% increase in their workload this summer and online planning applications have increased by 20%.

- On average, UK homeowners spend £48 billion a year doing up their homes. With a surge in people moving homes, online planning applications and builder demand, the 2020 spend may be higher.

- According to NAEA the top 10 home improvements to increase the value of your home are; redecorating, kitchen makeover, adding or updating bathrooms, garden appeal, double glazing, open plan space, new doors, loft conversions, creating a driveway and avoiding over personalisation.

- The top five common projects this year have been, extensions (74%), porches (9%), loft conversions (7%), conservatories (7%) and out buildings (3%). We suspect the need for a home office is behind many of these applications. Source: Dataloft, Planning Portal, NAEA