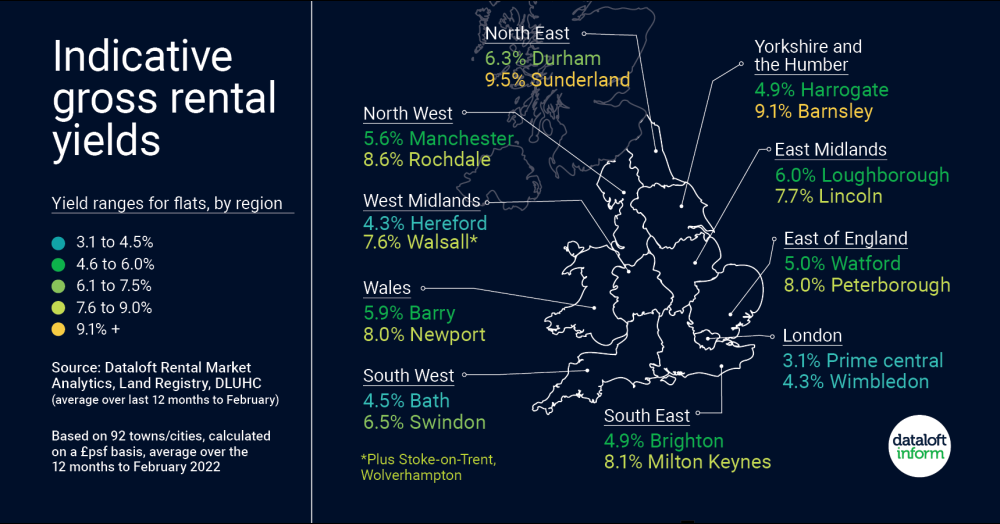

In this short article, we look at some comparison gross rental yields across the UK

- As of the end of February, gross yields for flats ranged from 3.1% in Prime Central London to 9.5% in Sunderland (North East).

- The spread of gross rental yields for key cities within a region currently averages 3%, with London having the narrowest at 1.2%.

- Yields are critical to measuring income returns and gross yields are a good starting point for quickly comparing locations and properties.

- Generally speaking private investors try to aim for gross rental yields of between 5% and 8%, in order to ensure they cover their costs and make a profit.

- Source: Dataloft Rental Market Analytics, Land Registry, DLUHC