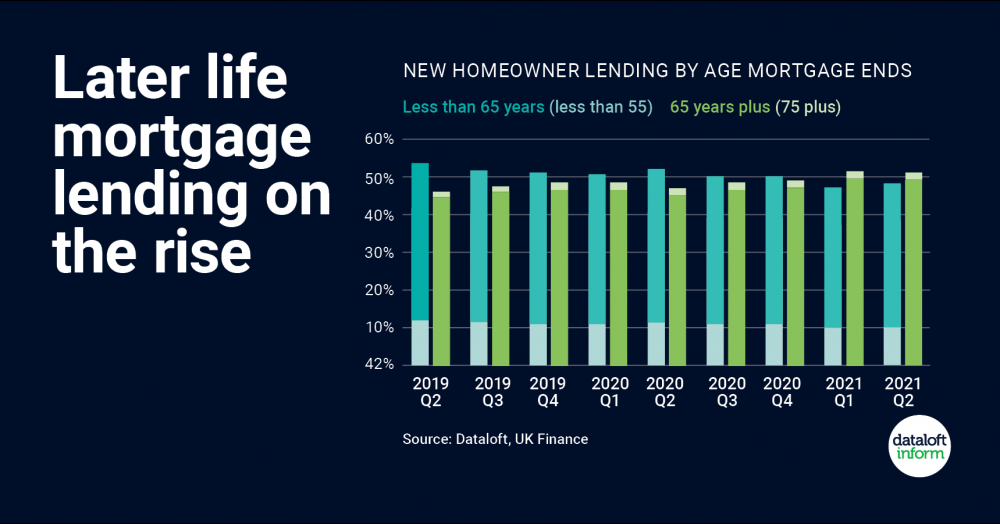

In this speed read we look at the length of home loans to borrowers likely to extend beyond their 65th birthdays

- Mortgage lending in later life is on the rise. The age of first-time buyers, an increase in the length of mortgage terms and an ageing population all causes.

- UK Finance report over half of new homeowner loans issued in the first six months of 2021 has an end date in excess of the borrowers 65th birthday.

- While the average age of a First time buyer is 32, over 1 in 4 are aged 35-44. The mortgage term for nearly half (47%) of recent First-time Buyers was 30 years or more (English Housing Survey).

- Such data indicates that in futures years the proportion of owner occupiers who own their property outright may well start to decline. Source Dataloft, UK Finance