In this short article we take a quick look at household savings during the pandemic

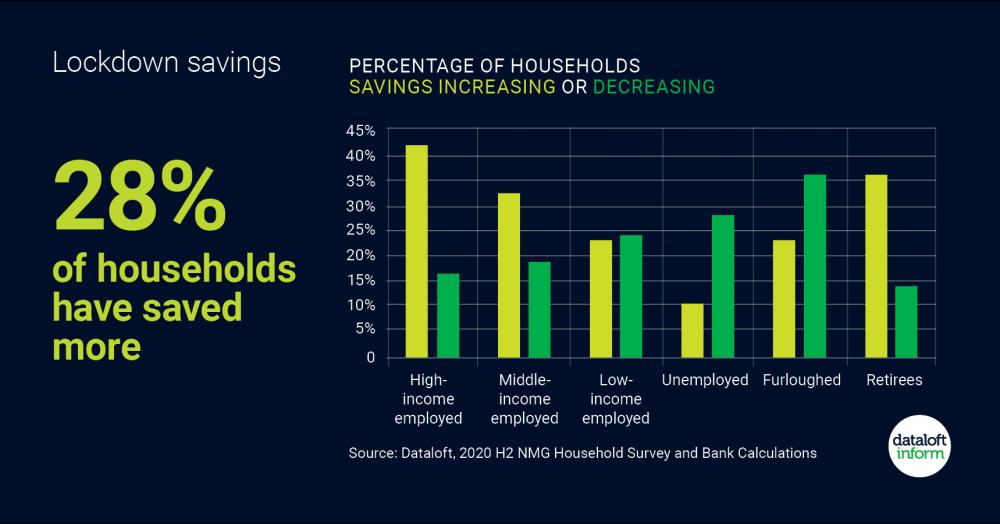

- The pandemic reduced spending for many households and government policies have helped support incomes. This has led to 28% of households saving more during the pandemic.

- 42% of high-income employed households saved more during the pandemic compared with 22% of low-income employed households. Retirees also saved more, 36% had increased their savings.

- Which households have saved more and what those households plan to do with their savings will impact the housing market.

- Households who have saved more could continue to support the higher levels of transactions and prices seen since May 2020. Source: Dataloft, 2020 H2 NMG Household Survey and Bank Calculations