Medium-term outlook for UK housing market

We take a quick look at some of the property forecasts for 2023

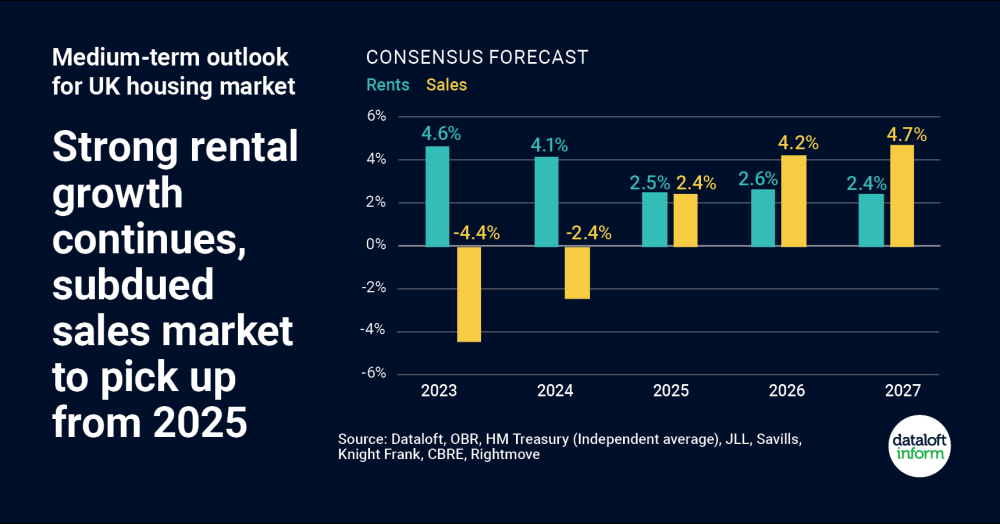

- Rental price growth is set to outpace sales price growth over the next two years. Driven by a shortage of stock and increased demand, rental growth averaging 3% per year is anticipated for the next 5 years.

- The average of the forecasts we have collated suggest UK house prices will fall by a total of -7% over the course of 2023 and 2024. At worst a fall of 10%, which is being forecast by some, will only take prices back to the summer of 2021.

- A decline in the number of homes sold in 2023 is likely, taking the annual total closer to 1 million, from 1.3 million expected this year.

- On a positive note, there is already evidence of improving affordability and choice in the mortgage markets and if this continues it should help to boost levels of buyer demand.

- Source: Dataloft, OBR, HM Treasury (Independent average), JLL, Savills, Knight Frank, CBRE, Rightmove, Zoopla, UK Finance