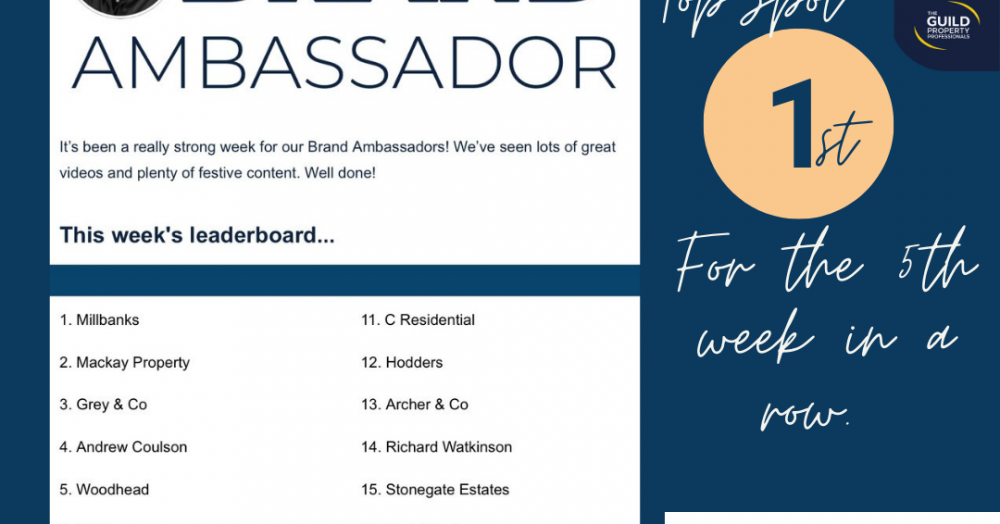

Millbanks Team have done it again!

If you are planning to sell in Attleborough, timing depends on more than luck. Property type, bedroom count, pricing and marketing all shape the outcome. Some homes attract swift interest, while others linger. Understanding local trends and launching at the right price from day one can make the difference between a smooth move and a stalled sale.

Spacious and beautifully presented, this four double bedroom detached home offers modern family living in a pleasant non-estate location. Featuring an open-plan kitchen/diner, separate lounge and study, en suite to the main bedroom, and a double garage, all within a short walk from village amenities

This map highlights the share of single-occupancy households across Attleborough. Darker areas show where more people live alone, while lighter areas reflect more family households. Behind the colours are very different life stages, from young first-time renters to long-standing residents, revealing the diverse fabric of the town.

More households are reassessing space in early 2026. If your home feels tighter than it once did, this spring may offer the right conditions to move up.