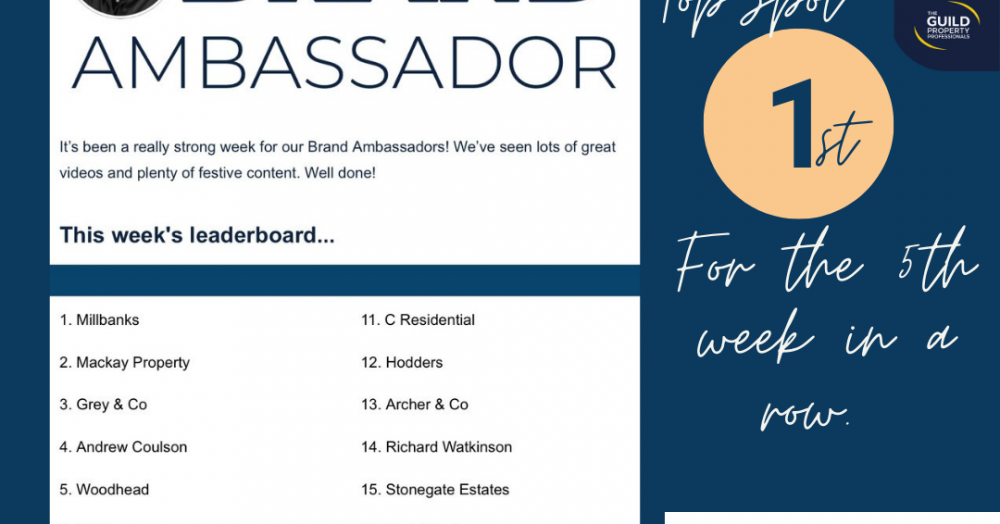

Millbanks Team have done it again!

Something significant is shifting on our streets, and most people have not noticed. Nearly one in five UK homes is now privately rented, quietly reshaping communities like Attleborough. Who is driving this change, and what does it mean for prices, demand, and neighbourhood life? The answers may surprise you.

Discover this superb modernised detached four-bedroom family home on Springfields, Attleborough, ideal for the centre of town. Boasting two reception rooms, two shower rooms, and a refitted kitchen, this home also includes a utility room, as well as a study/home office, and has a good size rear garden.

Managing a probate property while coping with loss can feel overwhelming. This gentle guide explains the key steps, realistic timescales for 2026, and what to expect when selling a home as part of an estate.

This heat map uses census data to show where Attleborough residents work longer hours, revealing clear differences in working patterns across the town. By understanding how work-life balance varies between neighbourhoods, we gain useful insight into local lifestyles and the factors shaping our community.