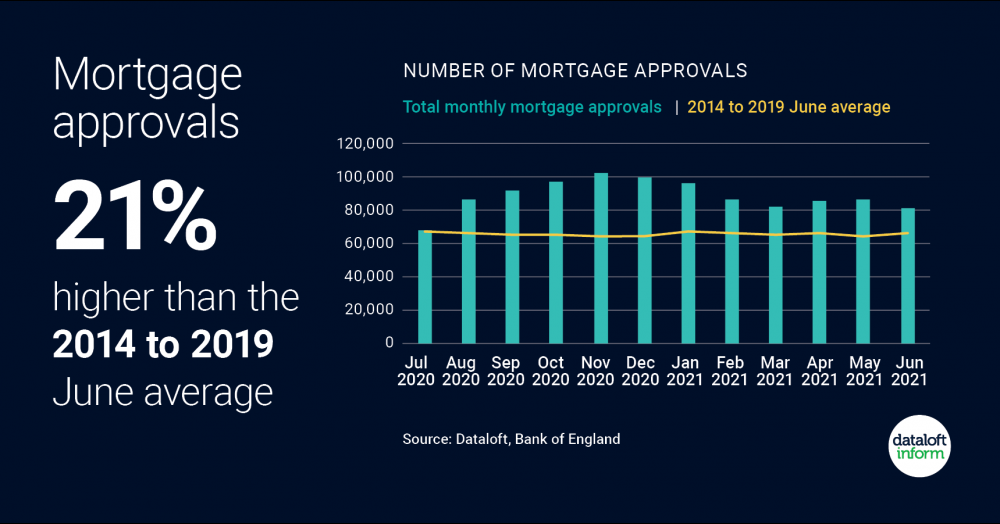

In this speed read, we take a quick look at recent mortgage approval numbers compared to the 2019 and 2014 averages.

- 81,338 mortgages were approved in June 2021, 21% above the 2014 to 2019 June average.

- Despite house prices increasing to an all-time high, mortgage payments haven't followed suit. Mortgage rates are close to an all-time low, so affordability has remained in line with the long-term average.

- First-time buyer lending is up 25% on last year (Zoopla), thanks to low mortgage rates and increased availability of high LTV mortgage products.

- With many searching for larger properties and more space, the number of properties available for first-time buyers has remained steady, average asking prices in this market up just 3.4% year-on-year (Rightmove).

- Source: Dataloft, Bank of England