Get in touch with us

If you own or rent property in Attleborough, tracking price trends matters. One useful indicator is the average price paid over the last 12 months, updated monthly. On its own it’s just a number, but over time it reveals direction, momentum, and what the local market may mean for your next property decision.

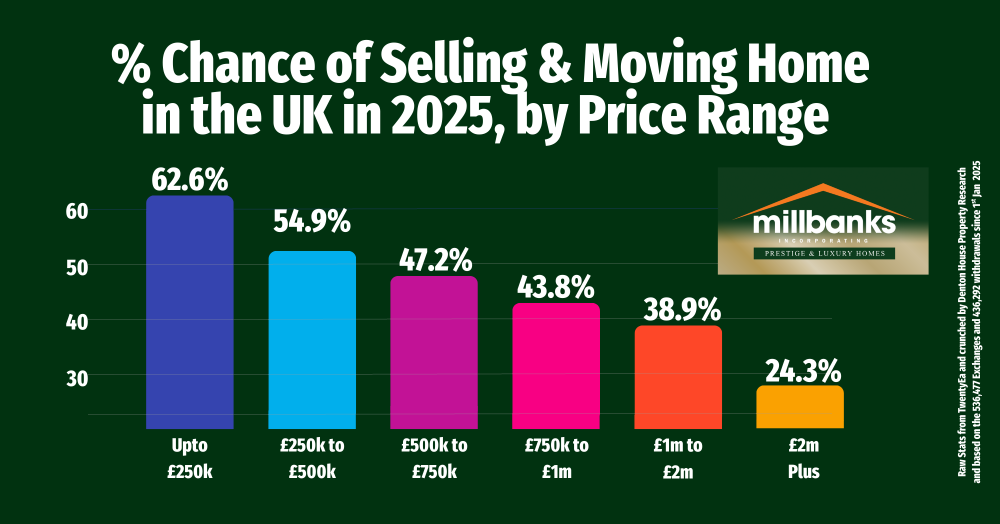

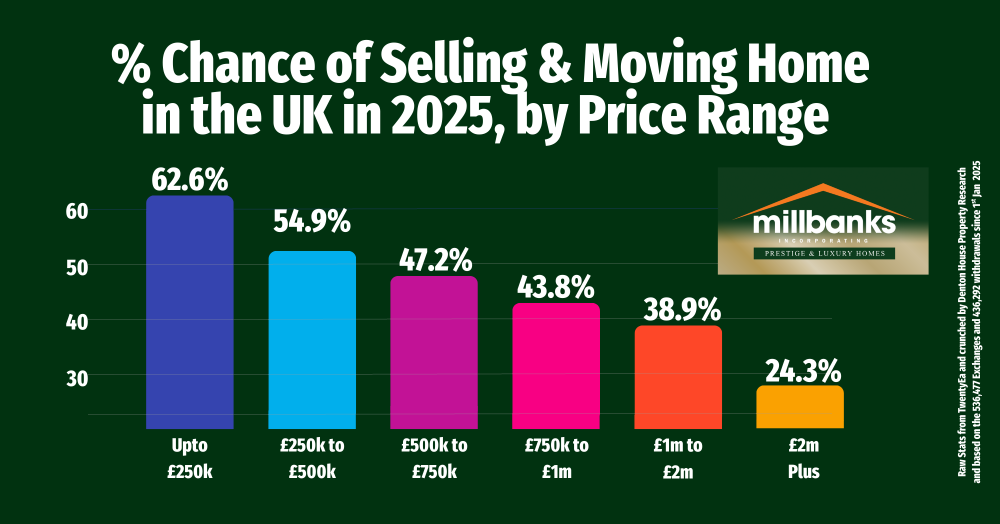

Nearly one in four agreed house sales in Attleborough failed to complete in 2025, a figure that catches many homeowners by surprise. This article explains why so many moves fall through, what it really costs local sellers, and the practical steps Attleborough homeowners can take to reduce risk and improve their chances of a successful move.

If you are planning to sell in Attleborough, timing depends on more than luck. Property type, bedroom count, pricing and marketing all shape the outcome. Some homes attract swift interest, while others linger. Understanding local trends and launching at the right price from day one can make the difference between a smooth move and a stalled sale.

Despite the headlines, first-time buyers in Attleborough are not locked out of homeownership. When you look beyond prices and focus on monthly mortgage costs, affordability today is far better than many realise. The data challenges the doom narrative and shows that, while deposits are tough, buying a first home is still possible.