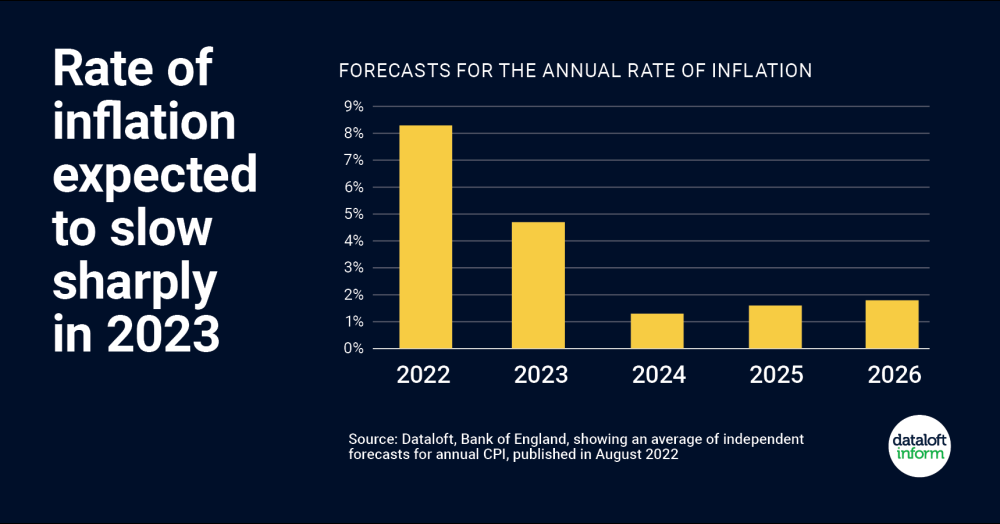

Rate of inflation expected to slow sharply in 2023

In this speed read, we look at independent forecasters expectations for inflation over the next 12 months

- As price rises spread throughout the economy, reports suggest the rate of inflation could reach 18% in early 2023, almost double its current rate of 10.1%, raising the possibility of further interest rate hikes.

- However, a consensus of independent forecasters expects the rate of inflation to slow over 2023 and, by 2024, have dipped back down below the Bank of England's target of 2%.

- It offers comfort to stretched households that this is expected to be a relatively short period of double-digit inflation compared to the prolonged period of steep price rises in the 1970s/early 1980s.

- In the meantime, whoever is announced as new Prime Minister on 5th September will come under increased pressure to help households.

- Source: Dataloft, Bank of England, showing an average of independent forecasts for annual CPI, published in August 2022