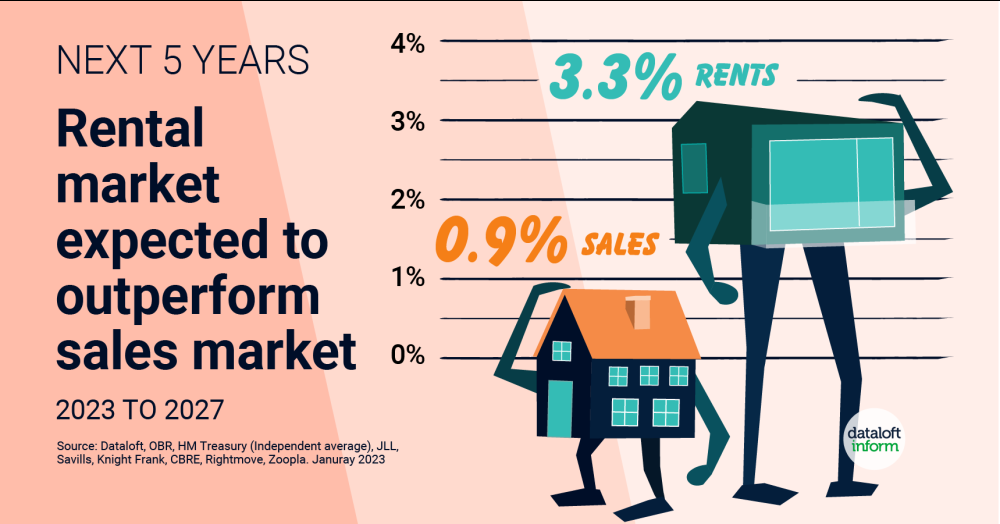

In this article we look housing market commentators and economists forecasts for the property market over the next 5 years

- An average of economists and housing market commentator forecasts over the next 5 years expect the rental market to out perform the sales market, at 3.3% compared to 0.9% per year.

- The sales market could see falls in average prices of homes by -7% by the end of 2024 but growth is then expected to return and average 3.8% per year between 2025 and 2027.

- In contrast, the rental market is anticipated to see its strongest rates of growth in 2023 and 2024 (4.4%) before stablising at 2.5% per year for the three year period 2025 to 2027.

- Housing markets that are less reliant on mortgage finance could record higher than average levels of growth. Improvements to the cost of borrowing may also result in a boost in demand in the sales market.

- Source: Dataloft, OBR, HM Treasury (Independent average), JLL, Savills, Knight Frank, CBRE, Rightmove, Zoopla