In this short article we look at tenant preferences between landlords who use an agent and landlords who self-manage.

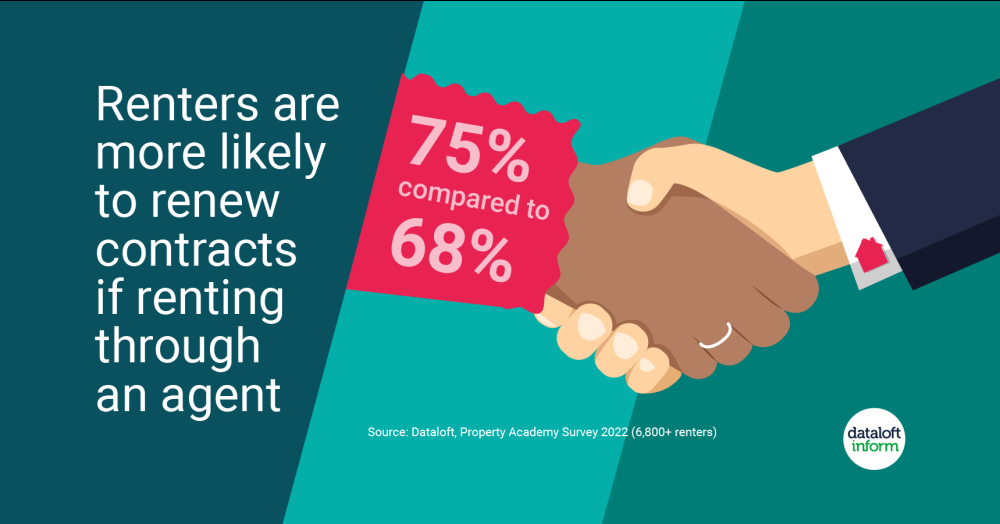

- Renters are more likely to renew their tenancy if they are renting through an agent than directly through a landlord, 75% compared to 68% (Property Academy).

- Yet nearly half of all private landlords were not using an agent to let or manage their properties, according to a survey of private landlords (DLUHC).

- Over half (53%) of renters who have an opinion on who they rent from, prefer to use a letting agent rather than deal directly with a landlord (Homelet).

- The private rented sector has doubled over the last ten years, accounting for 19% of households. 43% of landlords owned just one rental property (DLUHC) and would benefit from the services of a professional agent.

- Source: Dataloft, Property Academy Survey 2022 (6,800+ renters), DLUHC 2021, HomeLet Survey 10,700+ renters 2022