SPRING 2021 MARKET REPORT: PRICE GROWTH AT FOUR-YEAR HIGH - A year like no other.

Supply demand imbalance

Economic backdrop

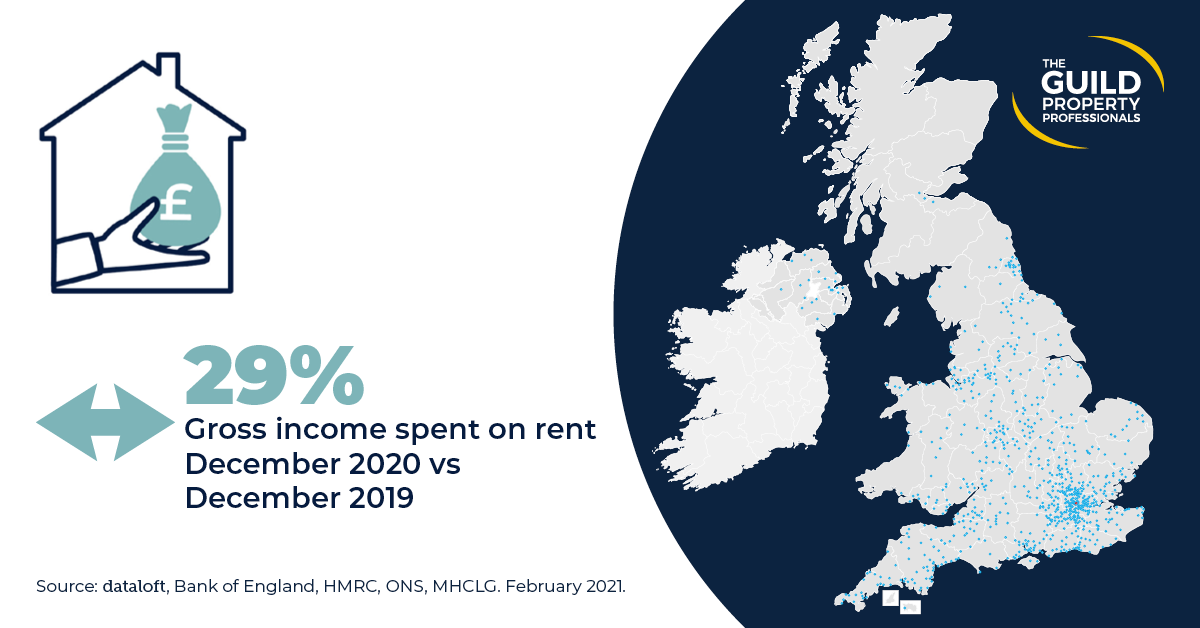

Rental market

This map highlights the average size of homes sold across the UK since 2020, measured in square feet from completed sales. What stands out is how little the averages vary between regions, despite very different housing types. Northern Ireland is the clear exception, with noticeably larger homes on average.

Following on from the Chancellor’s Autumn Budget, this article breaks down what the new tax measures really mean for Attleborough. With the feared £500,000 property tax dropped and a targeted Mansion Tax on £2m-plus properties introduced, I explore the likely impact on local homeowners, landlords, and tenants, separating headlines from reality.

If you want to move in 2026, positioning yourself as a serious buyer is essential. Here’s how to put yourself ahead of the competition and be taken seriously by sellers.

Attleborough homeowner or landlord? Each month we track the average price paid for local properties over the last 12 months to reveal where the market is really heading. If you’re thinking of selling or simply curious about your home’s true worth, staying informed puts you ahead.