The desire to move remains on the agenda for many, with little sign yet that economic headwinds are impacting the property barometer dial.

Sales

Standing firm

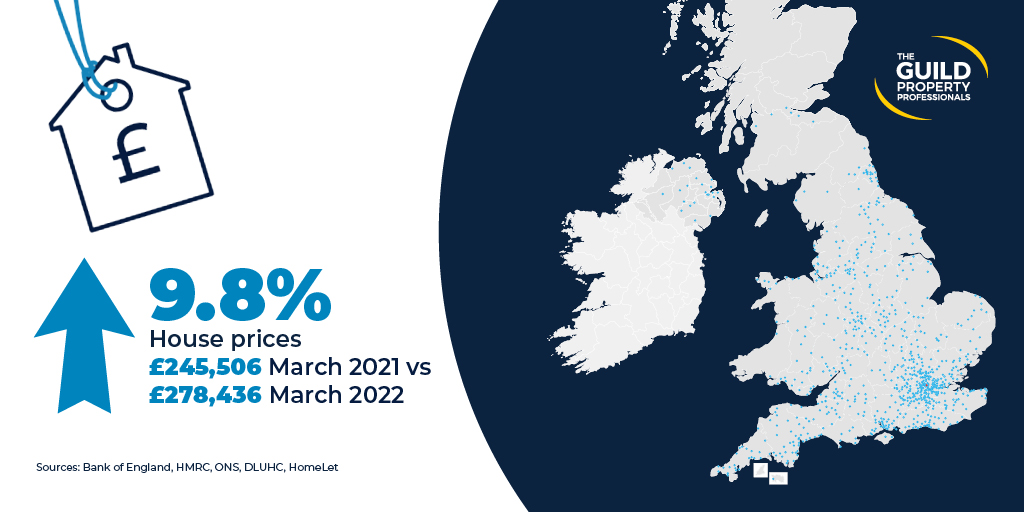

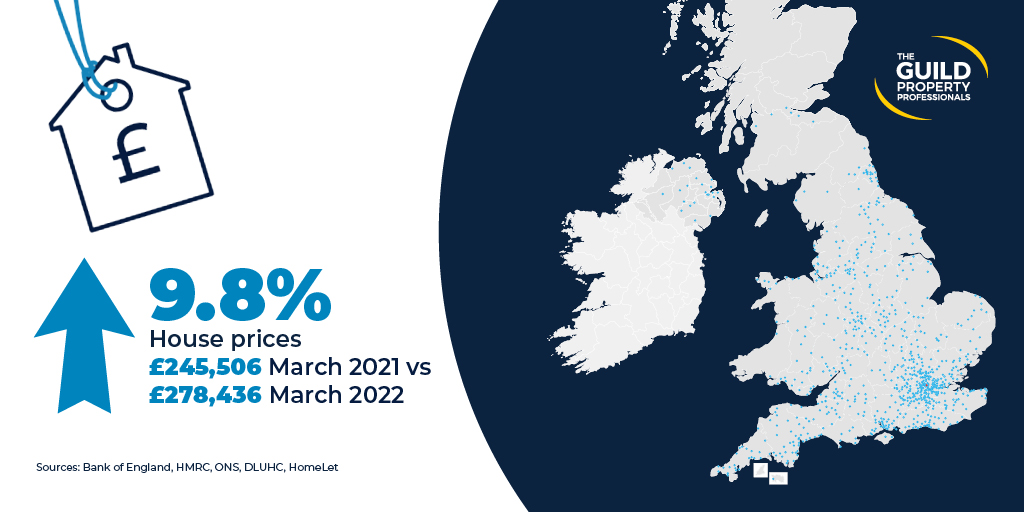

2022 has started strongly. Sales volumes in January are predicted to be 10% higher than their long- term (2012–2021) average and, except for a year ago, are the strongest since 2007 (Dataloft, HMRC). Buyer demand remains steadfast, up 16% year-on-year (Rightmove). Property price growth continues to be sustained; annual price growth in the year to January was at its strongest in over 15 years (Nationwide). Rightmove reported the biggest monthly jump in the asking price of a newly listed property since 1994 and when asked, the majority of agents are still expecting price growth over the next three- and 12-month period.

Winds of change

Although the quantity of property for sale remains low, with the Royal Institution of Chartered Surveyors (RICS) reporting stock levels per agent at a record low in January (barring the market closure in spring 2020), there are signs of change. New listings in January rose 11% year-on-year, with Rightmove noting a substantial rise in home valuation requests – an indication that many are looking to sell before they buy in current conditions. These should feed through to agents’ books over the coming months. Historically, March is the strongest time to sell, with the highest number of buyer enquiries per property for sale.

Sunshine and showers

Across the UK, governments are announcing their plans for ‘living with COVID’ and hybrid working is bedding in. With economic growth of 7.5% over the course of 2021, the UK economy is close to its pre-pandemic level. However, consumer confidence remains on edge due to the rising cost of living. Increases in the cost of food and clothing, along with rising fuel and energy prices, look set to squeeze many household incomes. Savings made during the pandemic might provide a cushion in the short term, and while interest rates may well rise from the current 0.5%, they remain low by historic standards.

Lettings

Rental demand soars

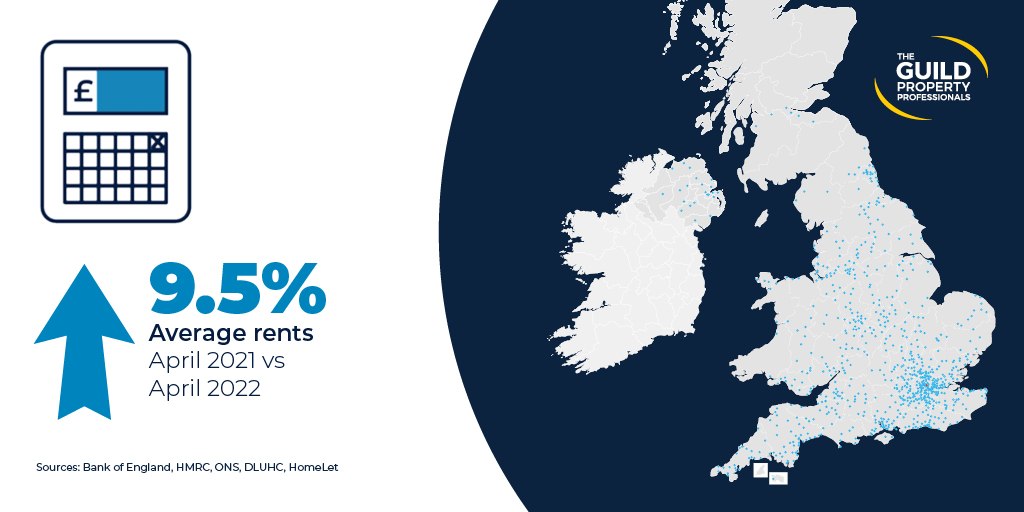

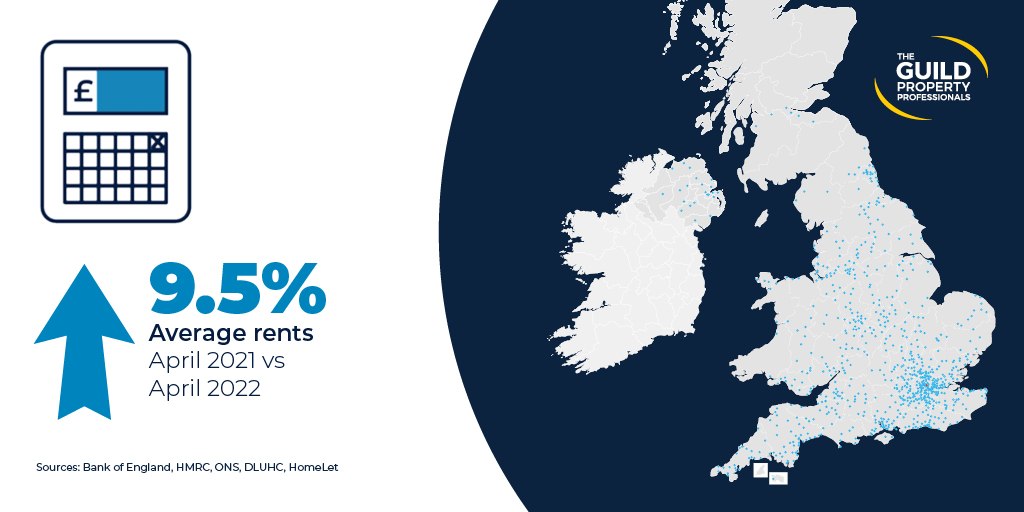

Demand for rental property is at an all-time high, with Rightmove reporting that renter demand is 17% higher than in January 2021, and up 33% compared to January 2020. Like the sales market, a shortage of property to let is underpinning prices, leading to rises in average rental values in all areas of the UK. However, many landlords are keen to keep existing renters: 76% would maintain a rent level if they were happy with the existing renter (Dataloft, Property Academy, 2021).

Regional Reports

Browse our Regional Market Reports:

Contact us today

To see a full copy of The Guild’s spring market report and for further guidance on the home moving process, take a look at the regional property market updates or get in touch with MILLBANKS today.

TEL:01953 453838

EMAIL: propertysearch@millbanks.com