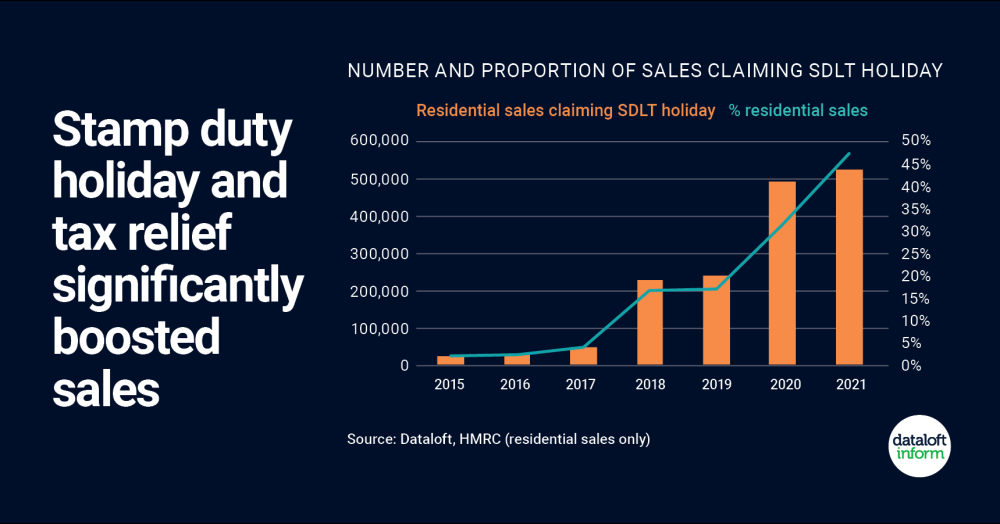

We take a close look at the Stamp Duty holiday last year and the impact it had on sales volumes

- 44% of home buyers in England were eligible for a Stamp Duty Land Tax (SDLT) holiday (or claimed relief) in 2021, totalling 566,700 sales.

- Those qualifying in the 5 years preceding 2020 averaged just 6%. This highlights the impact this incentive has had on stimulating the housing market.

- The SDLT holidays have contributed to sales volumes increasing by 43% in 2021, following six years of falls.

- It is estimated over 60% of purchasers in Wales benefitted from a reduction in stamp duty taxation during the first six months of 2021 (Stats Wales).

- Source: Dataloft, HMRC (residential sales only)