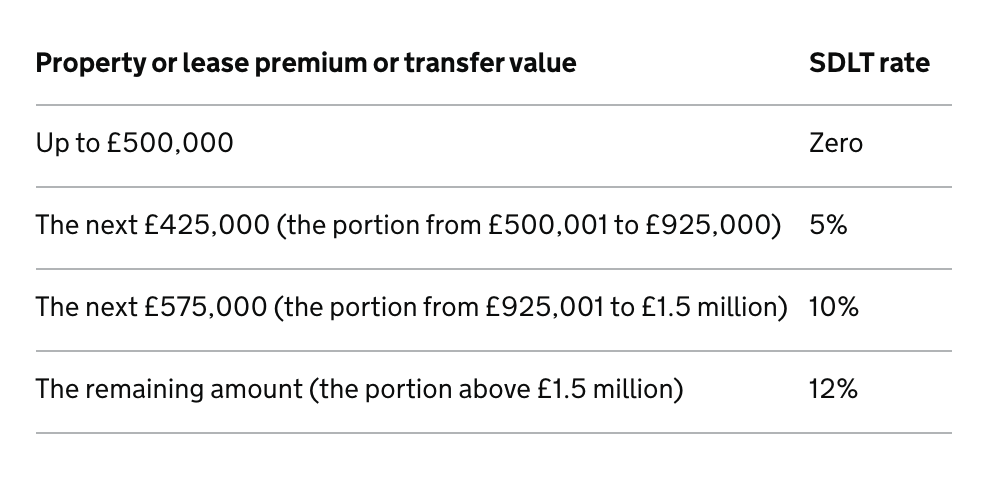

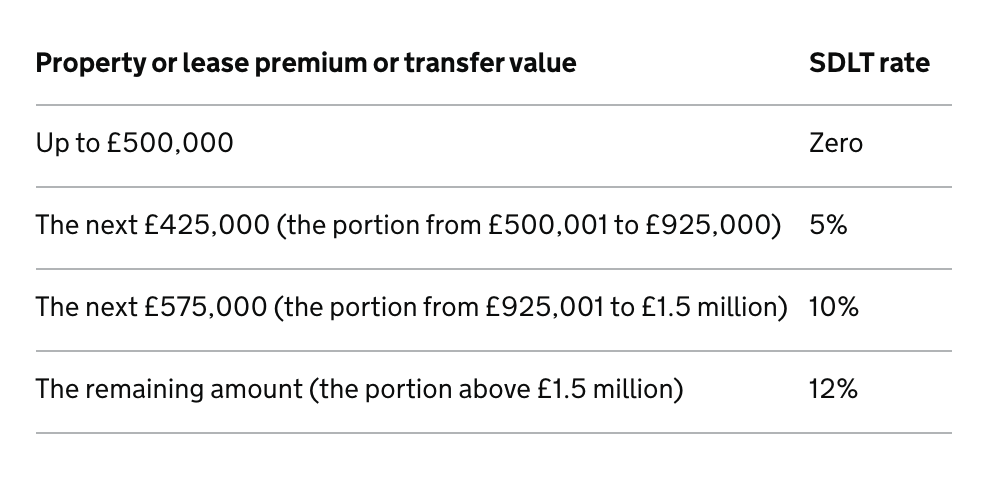

Stamp Duty Holiday will continue with No Stamp Duty on purchases up to £250,000 from 30/6 to 30/9

Despite the headlines, first-time buyers in Attleborough are not locked out of homeownership. When you look beyond prices and focus on monthly mortgage costs, affordability today is far better than many realise. The data challenges the doom narrative and shows that, while deposits are tough, buying a first home is still possible.

A modern two-bedroom end terrace house located in a pleasant non estate cul-de-sac position, offering an airy open-plan lounge/diner, sleek fitted kitchen, bright interiors, and an enclosed garden with summer house. Energy-efficient features and stylish finishes create an inviting contemporary home.

This heat map uses census data to show where Attleborough residents work longer hours, revealing clear differences in working patterns across the town. By understanding how work-life balance varies between neighbourhoods, we gain useful insight into local lifestyles and the factors shaping our community.

New Year, fresh goals, if moving home by spring 2026 is on your list, now’s the moment to plan. Understand how long properties took to go under offer and complete in 2025, and the key steps you need to hit your timeline. Read on to map out your best move ever.