Swap rates show fall in borrowing costs

In this speed read, we take a quick look at the swap rates which reflect the borrowing costs for lenders

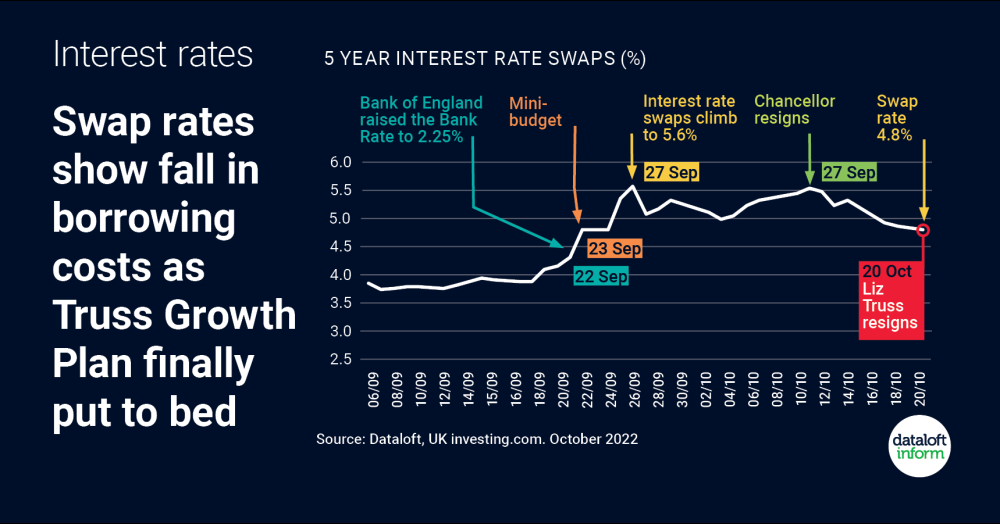

- Recent political instability added to volatility in the financial markets has pushed up the cost of borrowing.

- Swap rates are a good indicator of what to expect in borrowing costs because they reflect what borrowing costs for the lenders. 5-year swap rates rose to 5.6% after the mini budget but have since fallen back on the news of the Chancellor’s resignation and then again when the Prime Minister resigned.

- Lower swap rates show financial market approval that the Truss Growth Plan was finally put to bed.

- Overall, interest rates are definitely rising but recent volatility exaggerated the impact. Once the markets settle, there will be a clearer line of sight on interest rate expectations.

- Source: Dataloft, UK investing.com