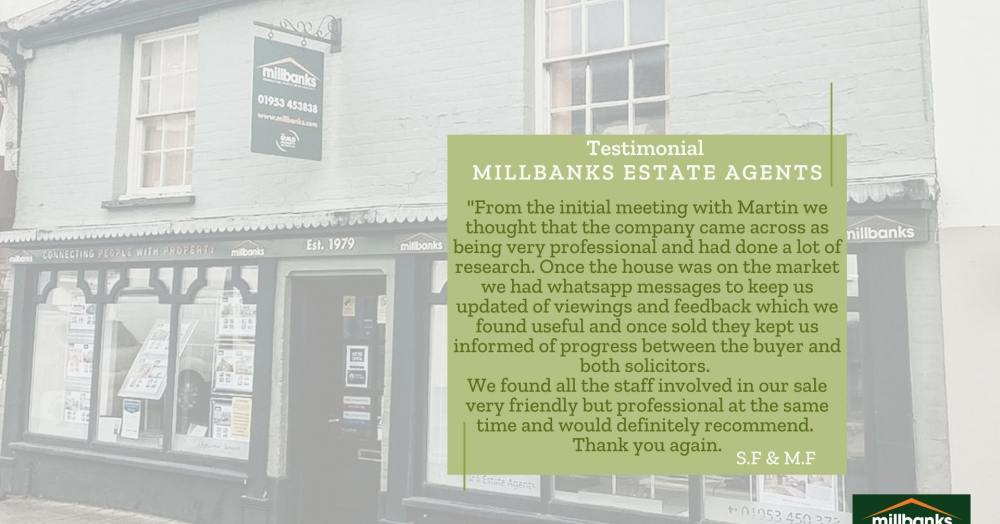

✨✨✨Thank you for this great TESTIMONIAL, we are glad to have helped you along your journey. ✨✨✨

Some homes sell swiftly while others linger, quietly slipping from view. The gap isn’t chance, it’s sellability. Price, presentation, and guidance decide who wins attention early and who stalls. Understanding what makes a home irresistible can turn uncertainty into momentum.

As 2025 draws to a close, this report examines how the UK and Attleborough property markets have performed and what may lie ahead in 2026. By comparing listings, sales, and prices with previous years, it reveals a market driven more by activity and confidence than by rising house prices.

The latest 0.25% interest rate cut may look modest on paper, saving the average variable mortgage holder around £31 a month, but its real influence runs deeper. Property markets are powered by confidence, and with mortgage rates easing and lenders competing again, sentiment is shifting. That change in mood is starting to matter.

This superbly presented 4-bed detached family home in Attleborough offers modern, comfortable living. Including dual-aspect lounge with ornamental fireplace, versatile dining/study, spacious kitchen/breakfast