Get in touch with us

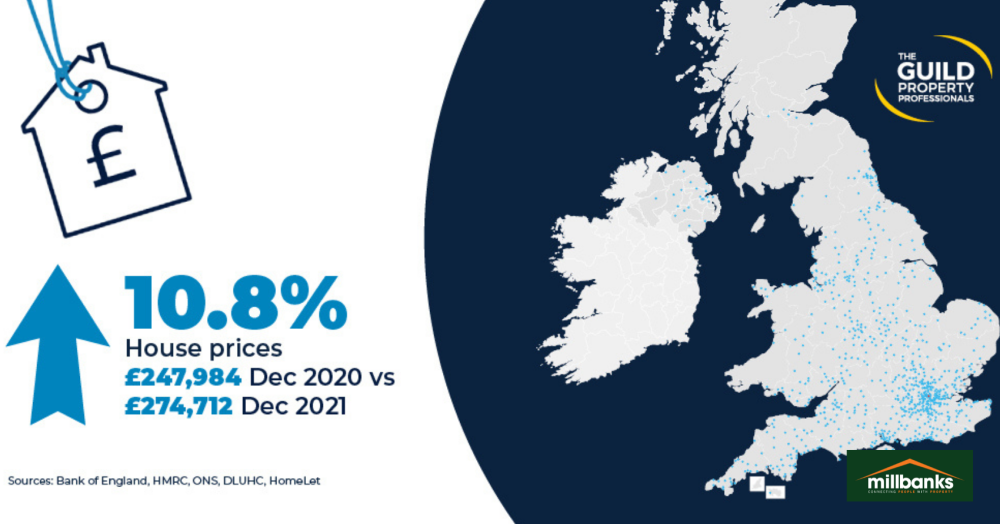

As 2025 draws to a close, this report examines how the UK and Attleborough property markets have performed and what may lie ahead in 2026. By comparing listings, sales, and prices with previous years, it reveals a market driven more by activity and confidence than by rising house prices.

A modern two-bedroom end terrace house located in a pleasant non estate cul-de-sac position, offering an airy open-plan lounge/diner, sleek fitted kitchen, bright interiors, and an enclosed garden with summer house. Energy-efficient features and stylish finishes create an inviting contemporary home.

Selling a family home is about more than moving, it’s about managing a transition with clarity, care and confidence. Here’s how to approach your move in early 2026 with less stress and more ease.

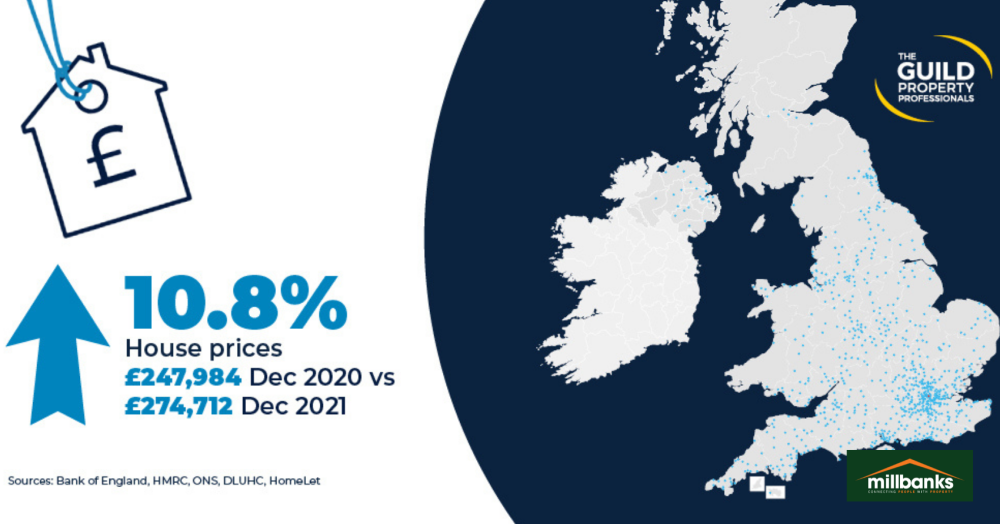

This map highlights parts of Attleborough where many homes have spare bedrooms sitting unused. Extra space brings comfort and flexibility, but it also carries costs and questions about whether a home still fits its owner’s stage of life. Understanding where space is underused helps spark thoughtful conversations about future housing choices.