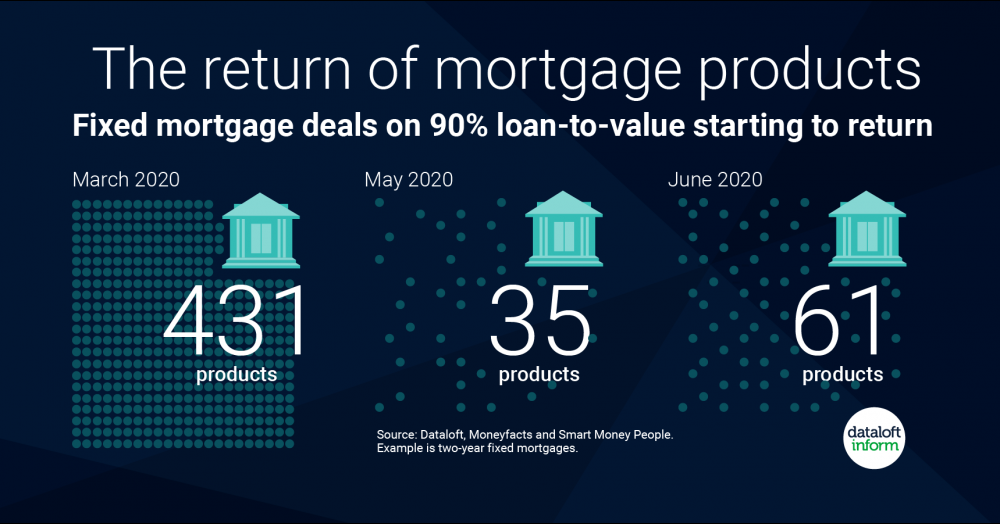

Fixed rate mortgage deals on 90% loan-to-value starting to return

- Mortgage products are returning following a collapse in availability during lockdown. 77% of mortgage brokers expect lending to return to pre-pandemic levels within nine months.

- The increase in mortgage products will be slow and steady, lenders are prioritising existing customers and the back log of around 350,000 sales which did not complete during lockdown.

- An example of mortgages returning; the number of two-year fixed mortgage deals on a 90% and 95% LTV fell from 431 in March to 35 in May. At the beginning of June there were 61 products, although the growth is all in 90% products.

- It's encouraging to see mortgage products return, but borrowers with a 5% deposit will find few fixed rate deals due to more cautious lenders. Since the data was published by Moneyfacts at the beginning of June, agents have also reported a reduction in 90% LTV products.