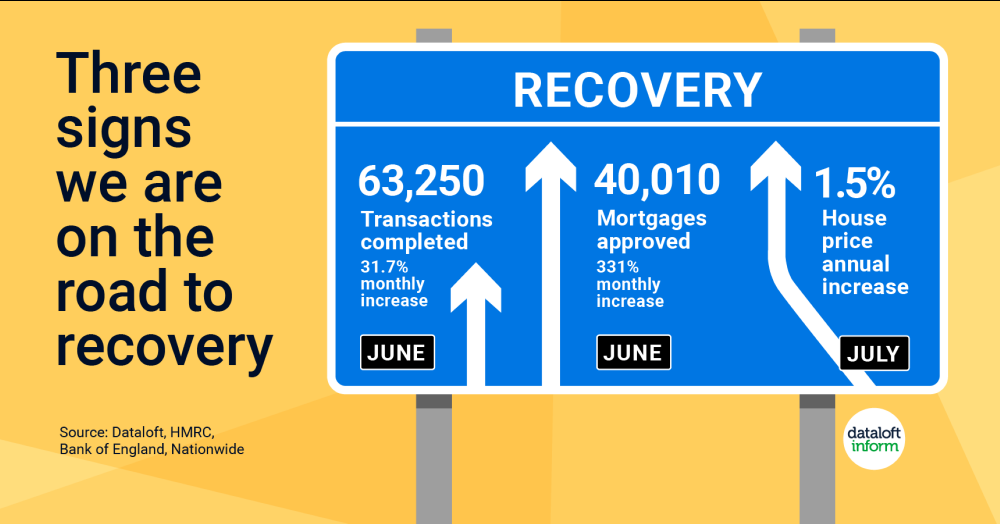

Three signs we are on the road to recovery

In this quick easy to read article, we look at the post lockdown housing recovery with some interesting statistics

- Transactions have increased, mortgage approvals are up and house price growth looks strong. With the stamp duty holiday creating increased demand, we expect this positive trend to continue.

- Nationwide house price index showed an annual increase of 1.5% in July. This follows some cautious June figures, -0.1% annual increase.

- 40,010 mortgages were approved in June. That’s 331% more than May, the lowest ever recorded, 9,273, but we are not back to normal yet as June approvals were -39.4% below last year.

- HMRC estimate 63,250 transactions to have completed in June, a 31.7% increase since May. There is still some way to go – sales remain -35.9% lower than June 2019. Source: Dataloft, HMRC, Bank of England, Nationwide

- https://vimeo.com/444603103