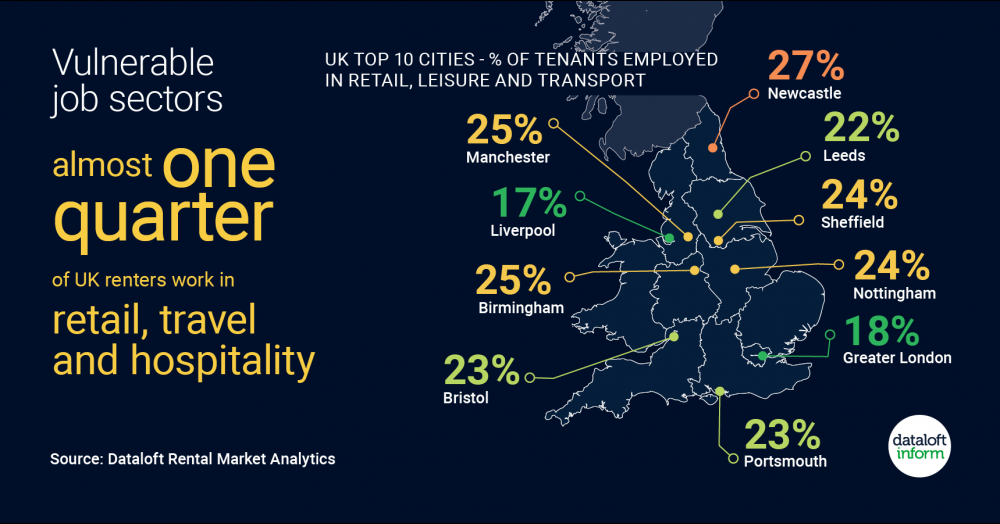

In this short article we look at the vulnerable job sectors and how this relates to the rental sector

- Unemployment rose to 4.8% in Q3, with a large proportion of job losses in leisure, retail and travel. Analysis of Dataloft’s tenant demographic dataset (DRMA) found almost a quarter of renters in the UK's top 10 cities work in retail, travel and hospitality.

- Retail (including online) is the employment sector for 12% of private tenants, leisure (including hospitality) accounts for 6% and transport 5%.

- The breakdown of tenants by employment sectors varies between the top 10 cities. Newcastle has the highest proportion working in retail, leisure and transport (27%) and Liverpool has the lowest (17%).

- Landlords are exposed to the economic impact of Covid-19 and those whose tenants work in leisure, retail and transport sectors are more vulnerable. Landlords should consider the implications of a temporary rent reduction or waiver, against the prospect of a void and the challenge of re-letting. Source: Dataloft Rental Market Analytics