In this short article we take a quick look at which areas are creating this spike in activity with research suggesting a surge in cash buyers

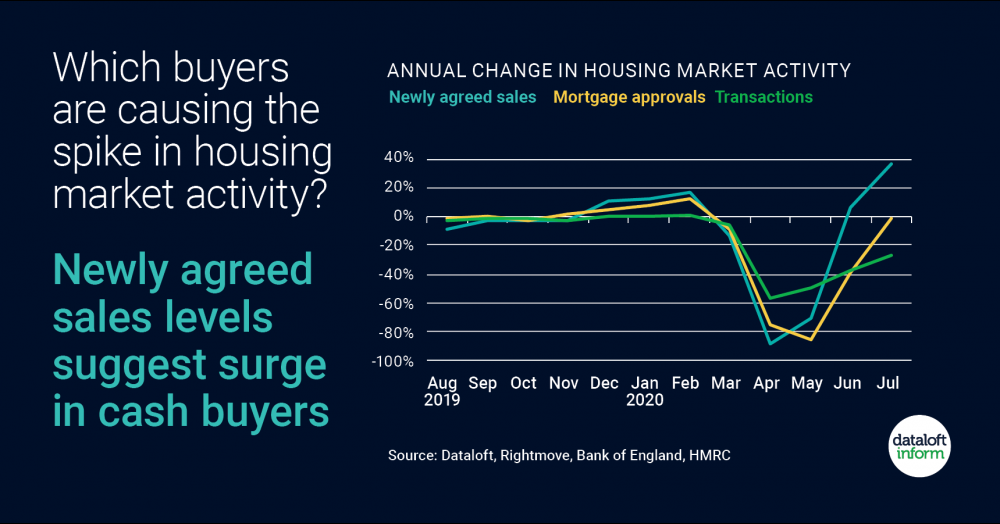

- July's mortgage data confirms a spike in housing market activity. Mortgage approvals are almost back to 'normal' levels, however newly agreed sales are much higher, suggesting a surge in cash buyers.

- 66,281 mortgages were approved in July, -0.9% annual decrease. 70,700 sales completed in July, a -27.4% annual decrease. Offer accepted to exchange takes c.9 weeks, therefore a lag is expected.

- Comparing housing market indices, sales agreed in July are higher than mortgages approved. This gap suggests cash buyers are a huge part of the surge in demand.

- Mortgage rates have increased for higher loan-to-value products and fewer products are available. Therefore, a large deposit or cash to own outright is essential. First-time buyers will be particularly hard-hit by this. Source: Dataloft, Rightmove, Bank of England, HMRC