In this two-minute read, we look at how landlords can foster a good rapport with tenants.

With country entering the latest phased release from lockdown this week, there has never been a more important time than to SHOP LOCAL and support local businesses

Here's our Top Tips Video Presentation with advice for anyone selling their property with pets, a 49 seconds watch

In this three-minute read, we list five things sellers should look for in an estate agent.

We take a look at the numbers of drinking and hospitality venues applying for licenses

Daffodils blooming, bumblebees buzzing, and birds singing.

We are delighted to offer this superb extended semi detached family house located in the village of Eccles and located within walking distance of the railway station.

The Chancellor’s decision to extend the stamp duty holiday has “put a spring in the step" of the housing market according to the Halifax.

New data from Hamptons shows that last year 131,900 properties were sold by landlords in Great Britain, the smallest sell-off since 2013, when 105,830 properties were sold.

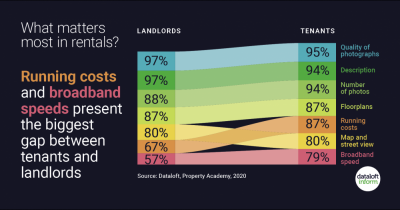

In this short article we look at the important factors around broadband speeds the importance tenants place on it

A two-minute read.

Now that we are slowly and carefully emerging from lockdown, we’ve created the Attleborough Promise to support our lovely town/village/community.