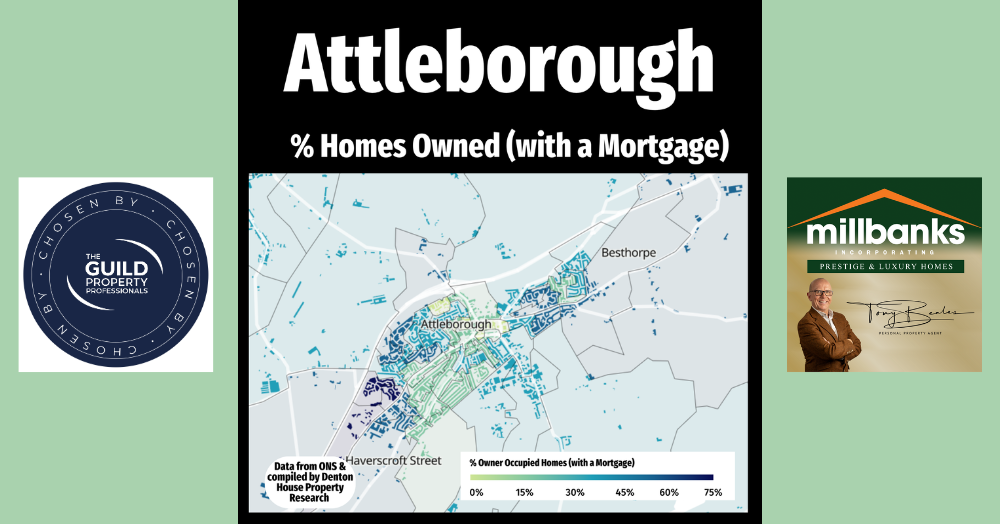

Attleborough: Homes Owned with a Mortgage – A Localised Snapshot

- 36% owned outright

- 28% owned with a mortgage or loan

- 19% privately rented

- 17% socially rented

This map reveals how homes in Attleborough are owned, from mortgage-free households to rented areas. These patterns matter because ownership shapes how and why people move, whether driven by lifestyle choices, long-term roots, or changing life stages, offering valuable insight into the local property landscape.

This map highlights the average size of homes sold across the UK since 2020, measured in square feet from completed sales. What stands out is how little the averages vary between regions, despite very different housing types. Northern Ireland is the clear exception, with noticeably larger homes on average.

Some homes sell swiftly while others linger, quietly slipping from view. The gap isn’t chance, it’s sellability. Price, presentation, and guidance decide who wins attention early and who stalls. Understanding what makes a home irresistible can turn uncertainty into momentum.

This visual snapshot reveals how property values rarely move in unison. Some streets surge ahead, others advance more quietly, each following its own rhythm. It’s a reminder that markets are made of micro stories, where proximity alone doesn’t guarantee the same outcome.