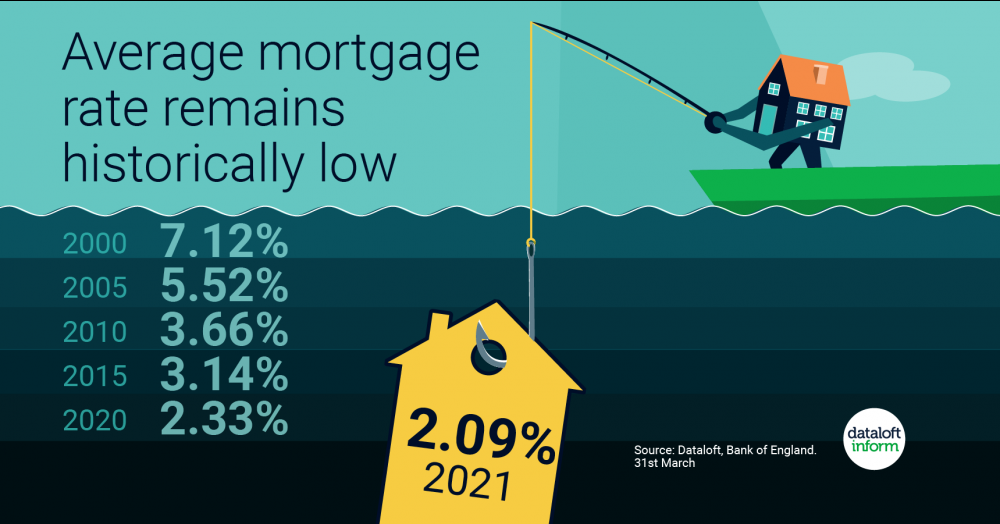

We take a quick look at the cost of borrowing

- The cost of borrowing remains historically low according to new data released by the Bank of England, the average mortgage rate just 2.09%.

- This rate has remained unchanged since the start of 2021, with gross mortgage lending in March hitting its highest ever monthly total at £35.6 billion.

- Mortgage approvals remain over 20% higher than the long term (5 year average), as interest in moving home continues.

- The Bank of England Monetary Policy Committee voted unanimously on 5 May to maintain rates at 0.1%. The next meeting is tomorrow 16th June.

- Source: Dataloft, Bank of England