We look at the potential benefits of the removal of the affordability test

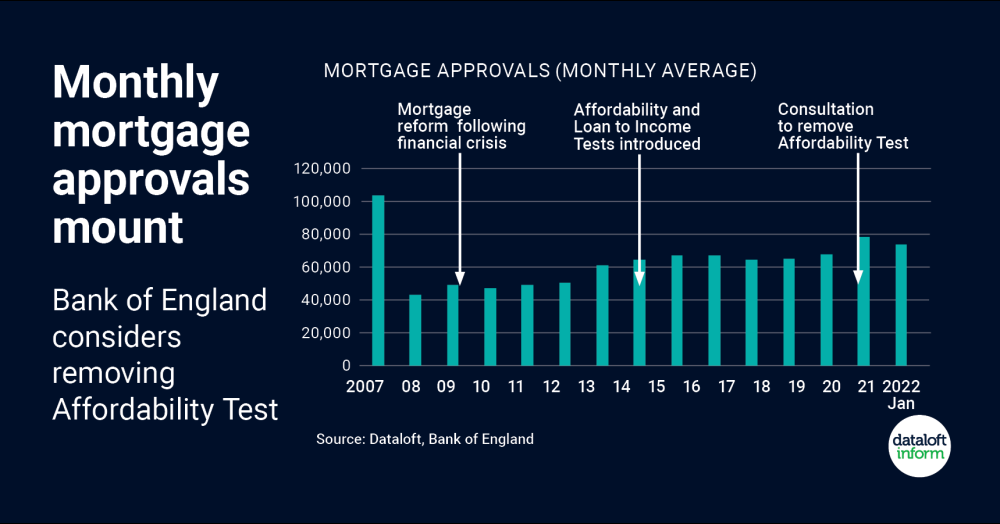

- Mortgage approvals, which surged in 2021 on the back of demand from home-movers, have sustained a high level into 2022, continuing to outpace any period since 2008.

- Meanwhile, the Bank of England is considering removing the ‘affordability test’ which tests a borrower’s ability to service their mortgage as interest rates rise.

- However the Loan to Income (LTI) multiple of 4.5 times income will remain and this is proved to be more effective at curbing risk during a housing 'boom'.

- The removal of the affordability test would make it easier for some first-time buyers to get a mortgage although, for an estimated 83% of renters finding a 5% deposit remains a barrier.

- Source: Dataloft, Bank of England