In this speed read we closer at last weeks interest rate rise and what this could mean going forward.

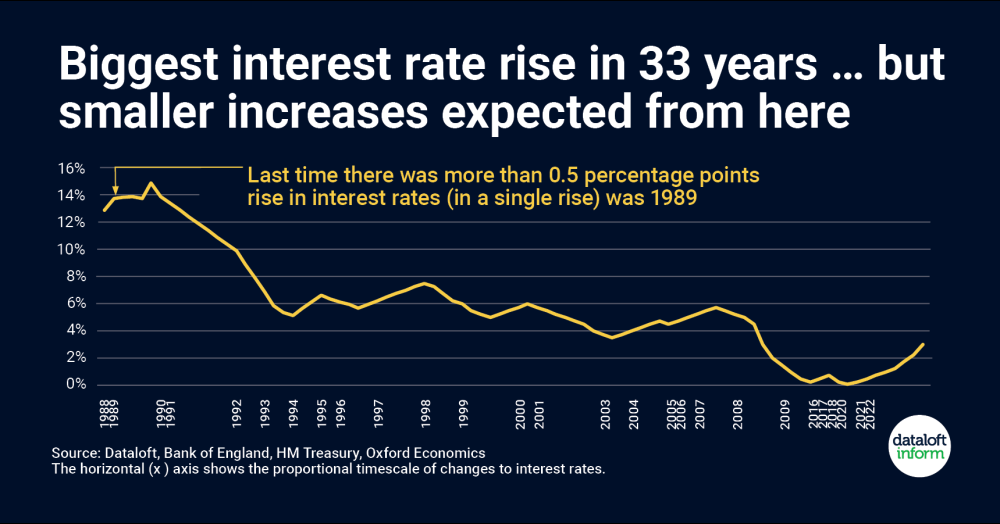

- On Thursday 3rd November 2022, the Monetary Policy Committee voted to raise interest rates by a further 0.75 percentage points to take interest rates in the UK to 3%. This is the biggest increase in 33 years to try and curb inflation.

- Only last month, the prediction was that UK interest rates would rise by 1 percentage point in November, so the increase is smaller than the housing market was previously expecting as sentiment has calmed after the change of Chancellor and Prime Minister.

- The HM Treasury Consensus Forecasts for 2023 anticipate inflation averaging 4.1% as a central scenario. Making a big change now should help limit the size of any further interest rate increases.

- Oxford Economics expects interest rates to continue to rise gradually from here and peak at 4% in 2024 before falling by a percentage point each year thereafter to 1.75% by 2027.

- Source: Dataloft, Bank of England, HM Treasury, Oxford Economics