We look at the shortage of housing stock in the current property market

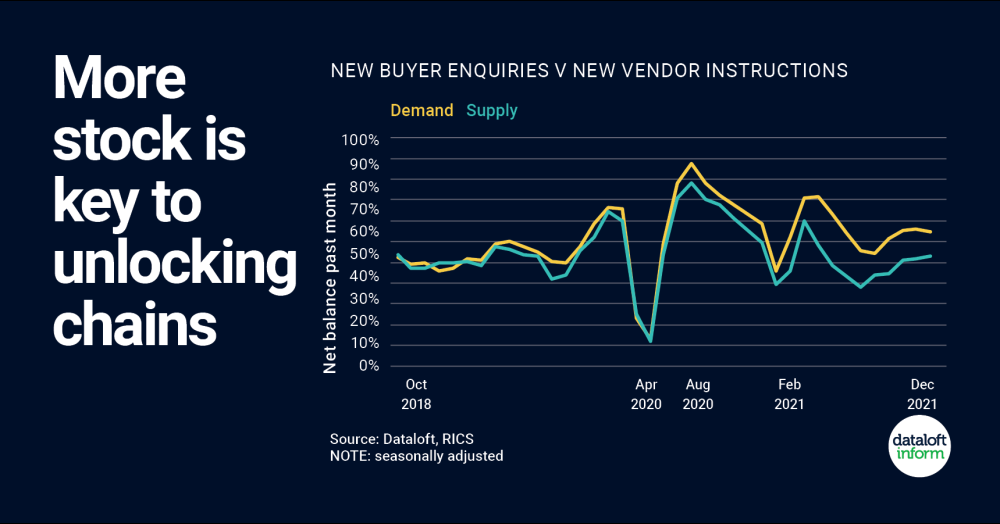

- New buyer enquiries rose modestly in December (+9%) marking the fourth successive monthly rise in demand.

- The end of the stamp duty break curtailed demand to some degree but since market reopened back in June 2020 demand has significantly outpaced the level of supply (new instructions).

- Demand has been outpacing supply ever since the market reopened in June 2020 with only a slight deceleration when the stamp duty break came to an end.

- New instructions recorded a net balance of -14% in December resulting in a 9 month run of falls. It is this lack of stock that is putting a cap on sales activity.

- House price growth is likely to continue due to the imbalance in supply and demand. More stock is needed to unlock the system and ensure chains can be completed.

- Source: Dataloft, RICS