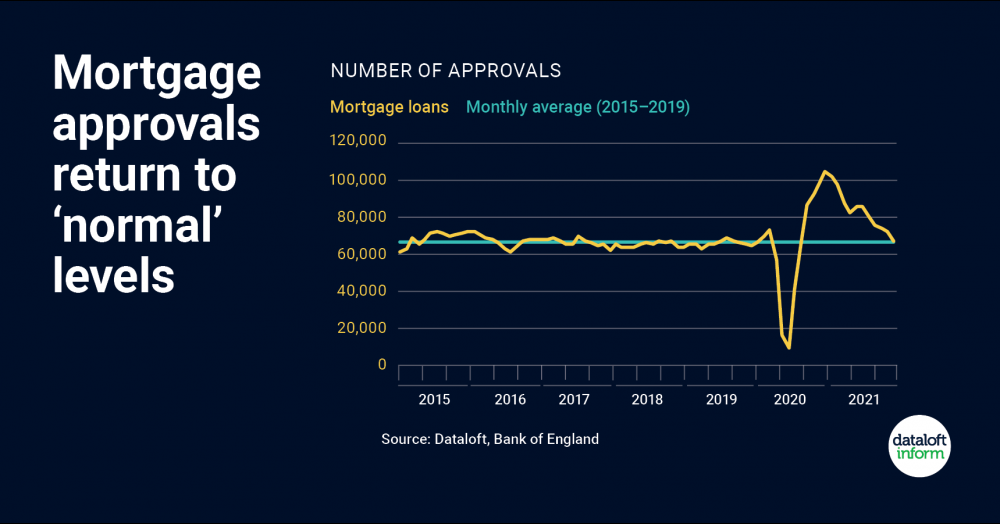

In this speed read article we look closer at the return to normal of Mortgage Approvals

- October saw mortgage approvals return to more 'normal' levels.

- The Bank of England report 67,199 mortgages were approved in October, just above the long-term monthly average of 66,462 (based on 2015–2019).

- The property market is predicted to return to calmer market conditions during the first quarter of 2022. The volume of new supply to the market is expected to rise.

- Rising inflation and the probability of a rise in the base rate of interest looks set to impact on buyer affordability in 2022 and beyond.

- Source: Dataloft, Bank of England