Get in touch with us

As 2025 draws to a close, this report examines how the UK and Attleborough property markets have performed and what may lie ahead in 2026. By comparing listings, sales, and prices with previous years, it reveals a market driven more by activity and confidence than by rising house prices.

The latest 0.25% interest rate cut may look modest on paper, saving the average variable mortgage holder around £31 a month, but its real influence runs deeper. Property markets are powered by confidence, and with mortgage rates easing and lenders competing again, sentiment is shifting. That change in mood is starting to matter.

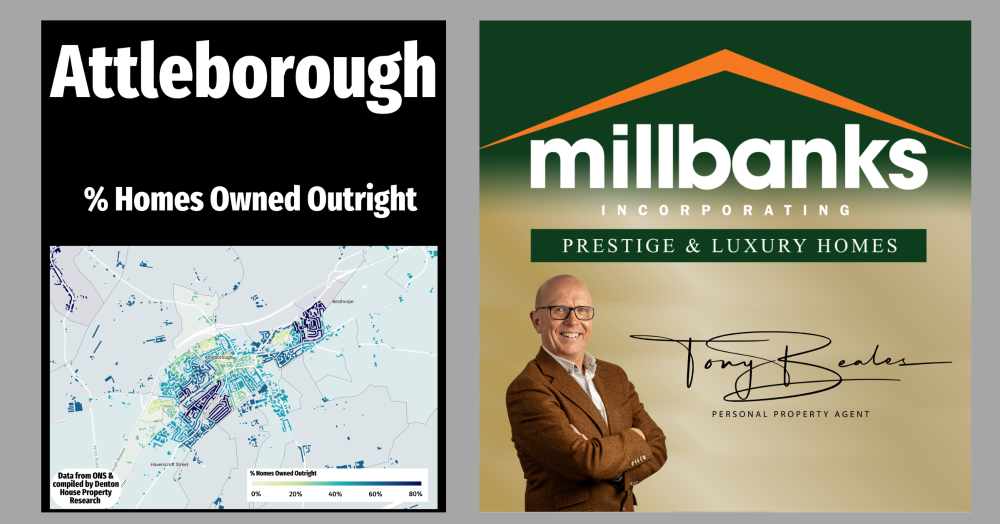

Attleborough’s property market has a pulse, measured by asking prices per square foot and shaped by the homes currently for sale. This snapshot helps homeowners and landlords read the mood rather than pure value change.

Despite the headlines, first-time buyers in Attleborough are not locked out of homeownership. When you look beyond prices and focus on monthly mortgage costs, affordability today is far better than many realise. The data challenges the doom narrative and shows that, while deposits are tough, buying a first home is still possible.