In this quick speed read, we look ahead to the challenges the property market faces in 2023

- With rising interest rates and more challenging affordability (especially for first-time buyers), sales volumes will likely slow in 2023.

- Uncertainty has an impact on housing market activity; with a new Prime Minister and Chancellor there is hope that this extra layer of uncertainty clears.

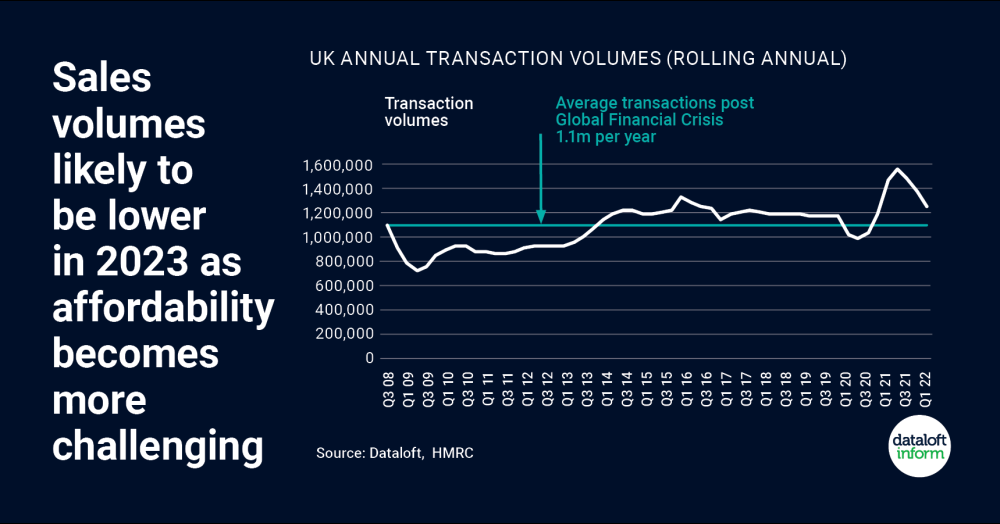

- Current sales volumes are just over 1.2 million a year; a 12% fall would take them to the average level post the Global Financial Crisis.

- More significant falls are possible dependent on where interest rates end up but there are some counter indications in today’s market.

- Recent behavioural changes from Covid are still driving demand as movers look for more outside space and space to work from home.

- Family circumstances mean there is always a core level of sales activity, plus 56% of owner occupiers have no mortgage and won’t be affected by interest rate rises.

- Source Dataloft, HMRC