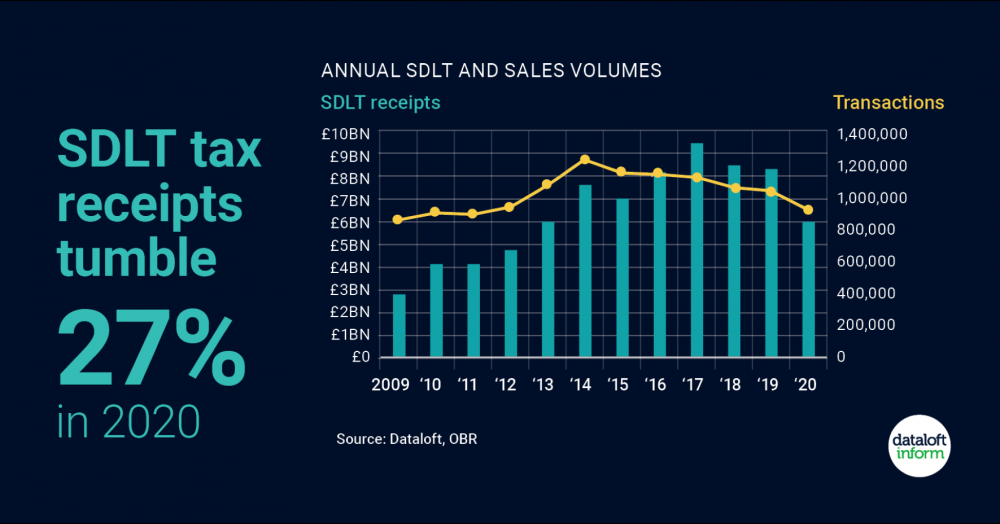

We take a quick look at the fall in SDLT receipts over the last 12 months

- Just over £6 billion was collected by the Treasury in England in SDLT property tax in 2020. This is £2.2 billon less than in 2019, a 27% fall.

- Over 300,000 property transactions were ineligible for tax in the final 6 months of the year, the majority a result of the Stamp Duty Holiday.

- The number of sales over £1 million rose by over 10%, many purchased as a main residence as the number liable for HRAD tax fell.

- The extension of the SDLT holiday until the end of June, and 0% payable on properties up to £250,000 until the end of September will undoubtedly impact the government purse for 2021. Source: Dataloft, OBR