Get in touch with us

With ongoing reforms and rising compliance demands across the UK, managing a rental property alone is becoming increasingly complex. Here’s why professional management now matters more than ever.

A modern two-bedroom end terrace house located in a pleasant non estate cul-de-sac position, offering an airy open-plan lounge/diner, sleek fitted kitchen, bright interiors, and an enclosed garden with summer house. Energy-efficient features and stylish finishes create an inviting contemporary home.

Following on from the Chancellor’s Autumn Budget, this article breaks down what the new tax measures really mean for Attleborough. With the feared £500,000 property tax dropped and a targeted Mansion Tax on £2m-plus properties introduced, I explore the likely impact on local homeowners, landlords, and tenants, separating headlines from reality.

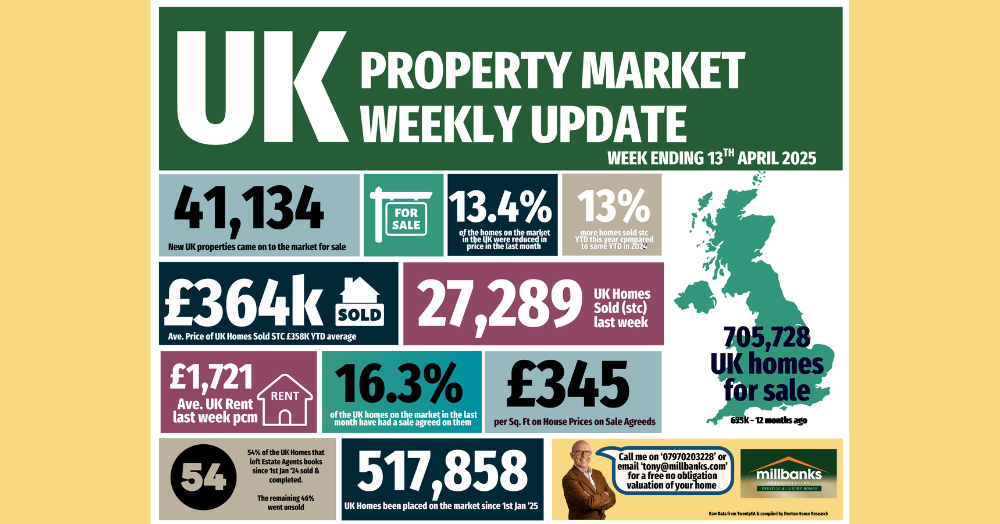

With plans announced to raise the council tax surcharge on higher-value homes, this snapshot looks at how many £2m-plus properties have actually sold across the UK this year. The data shows a highly concentrated market, dominated by London, and reveals just how small this sector is nationally despite the noise around a “mansion tax.”