Get in touch with us

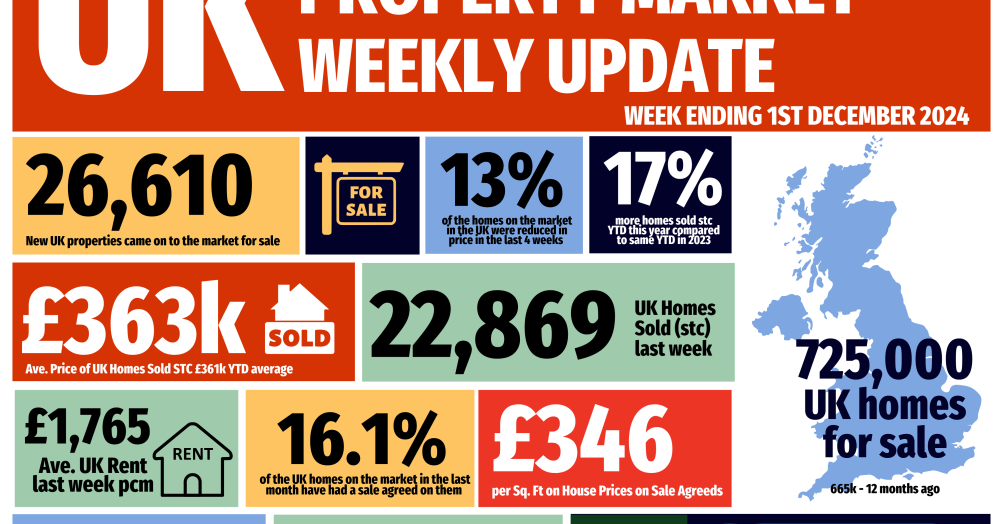

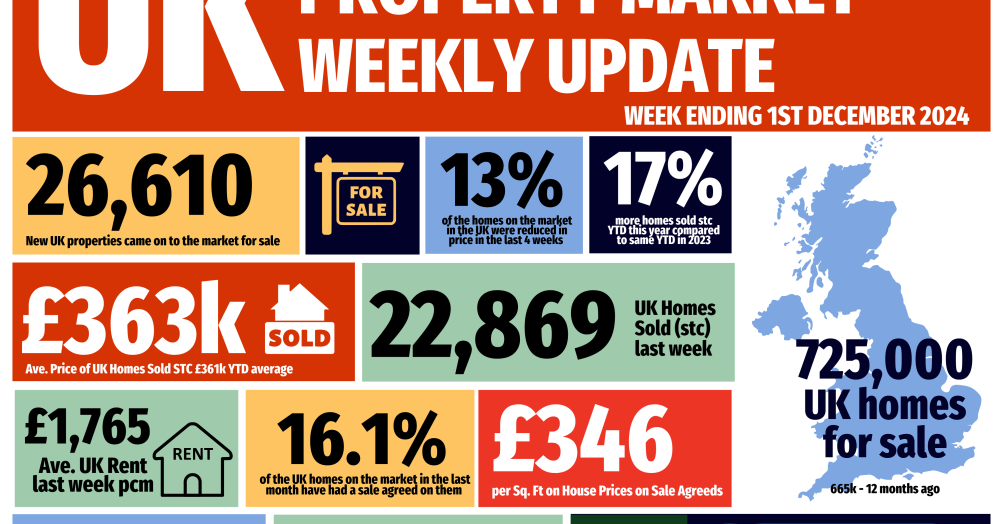

This data shows a clear north–south split in UK housing supply. Homes for sale are rising across London and the South, while much of the North is seeing stock fall. The contrast raises questions about affordability, confidence, and whether higher supply in the South could limit house price growth into 2026.

'Video Watch' - Individual 4-Bedroom Det House with Dbl Garage on Plot of Approx. Quarter of an Acre

An impressive individual 4-bedroom detached family home, situated in a non estate position on a plot of approx. a quarter of an acre plot and ideal for the centre of town, with a super south-facing rear garden, generous parking, a double garage and great potential to create the home of your dreams.

Want first access to the best homes in 2026? Discover how our tech-led Heads Up Property Alerts help you see properties before they reach Rightmove—so you never miss out on your dream home again.

Selling a family home is about more than moving, it’s about managing a transition with clarity, care and confidence. Here’s how to approach your move in early 2026 with less stress and more ease.