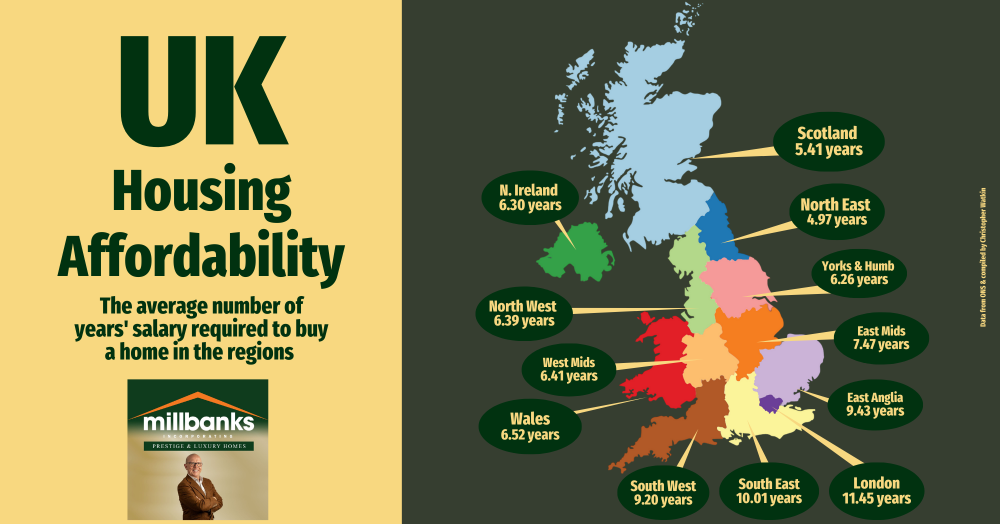

Housing affordability in the UK is a significant concern, and analysing how long it would take to buy a home in different regions based on average salaries provides a clear picture of the financial challenges many face.

The housing affordability data across the UK provides an insightful snapshot of how long it would take to buy a home in different regions based on average salaries:

- North East: 4.97 years

- Scotland: 5.41 years

- Yorkshire & Humberside: 6.26 years

- Northern Ireland: 6.30 years

- North West: 6.39 years

- West Midlands: 6.41 years

- Wales: 6.52 years

- East Midlands: 7.47 years

- South West: 9.20 years

- East Anglia: 9.43 years

- South East: 10.01 years

- London: 11.45 years

These figures paint a picture of housing affordability across the country, providing a valuable context for Attleborough homeowners and potential buyers. It’s clear that property prices differ significantly depending on where you are, but for those in the local Attleborough market, understanding these affordability comparisons helps to shape expectations around property values and potential future trends.

While affordability may seem daunting in certain parts of the country, it's important to remember that today’s mortgage payments, as a percentage of take-home pay, are only slightly above the long-term average.

Despite rising property prices, the affordability landscape is far more balanced than it may appear, especially when considering historical interest rates.

This balance ensures that homeownership remains an achievable goal for many, even in more challenging market conditions. Keeping a finger on the pulse of national trends can help to inform decisions locally, offering a broader perspective on housing affordability.

If you have any questions about the Attleborough property market, feel free to pick up the phone on (07970203228) and talk to me Tony Beales.