A quick look at Green Mortgages

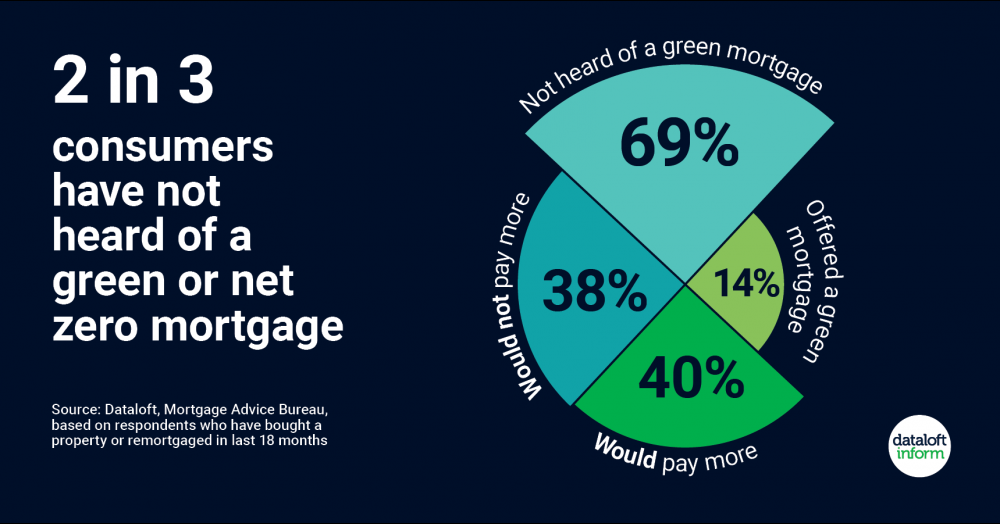

- Just one in 7 consumers has been offered a green or net zero mortgage product, while two-thirds have not heard of them, according to new research released by the Mortgage Advice Bureau (MAB).

- Green mortgages reward owners for owning an energy efficient home, either through favourable terms such as a slightly lower interest rate or via cashback on approval.

- The proportion of consumers willing to pay more and not willing to pay more for a green mortgage was fairly evenly balanced.

- The number of green mortgage products is set to increase. The MAB found just 1 in 4 lenders (based on 69 lenders) currently offer a product. 88% of those that don't, have plans to do so.

- Source; Dataloft, Mortgage Advice Bureau, based on respondents who have bought a property or remortgaged in last 18 months