We look at the current property market, the outlook for the next 12 month and how things were pre-pandemic

- The UK has dealt with historic temperatures this last week or so, and although the scorching heat of the housing market is showing some signs of moderating as month-on-month price rises soften, it remains sunny for those looking to buy and sell.

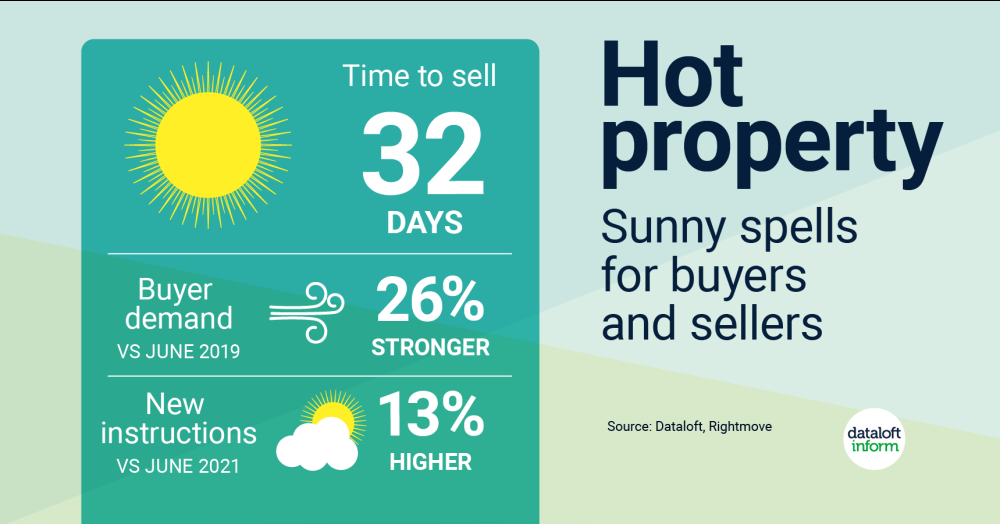

- Rightmove report that buyer demand, while down year on year, is 26% stronger than in pre-pandemic June 2019, with the volume of new sellers to the market up 13% compared to this time last year. At 47, average stock levels per agent have improved since the start of the year.

- With the volume of new instructions still failing to keep track with demand, properties continue to sell (SSTC) in just 32 days. This is 6 days faster than a year ago, and over three weeks quicker than the pre-pandemic June average.

- The cost of living crisis is likely to dampen the market over the second half of 2022, but a net balance of agents still anticipate price growth over the next 12 months (RICS).

- Source: Dataloft, DLUHC, Land Registry