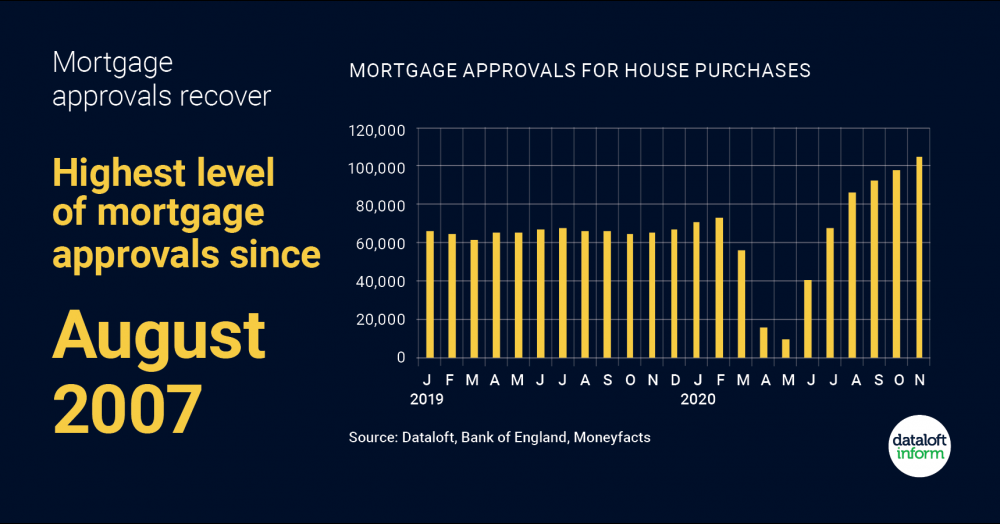

In this short article we look at the recovery of the mortgage market

- Mortgage approvals have all but recovered following the forced closure of the housing market in spring 2020. Mortgage approvals were only down -0.9% (January to November 2020) compared to the same period in 2019.

- 104,969 mortgages were approved in November 2020, the highest level since pre-Global Financial Crisis. Lenders expanding the number of mortgages available to first-time buyers helped boost recent figures.

- 160 deals are currently available for buyers with a 10% deposit, up from a low of 51 in October 2020. However, this is still significantly lower than the 762 deals that were available in January 2020.

- The remarkable recovery of mortgage approvals has been thanks to households re-evaluating their housing requirements and fuelled by the stamp duty holiday. Source: Dataloft, Bank of England, Moneyfacts