As 2025 draws to a close, this report examines how the UK and Attleborough property markets have performed and what may lie ahead in 2026. By comparing listings, sales, and prices with previous years, it reveals a market driven more by activity and confidence than by rising house prices.

This data shows a clear north–south split in UK housing supply. Homes for sale are rising across London and the South, while much of the North is seeing stock fall. The contrast raises questions about affordability, confidence, and whether higher supply in the South could limit house price growth into 2026.

This visual snapshot reveals how property values rarely move in unison. Some streets surge ahead, others advance more quietly, each following its own rhythm. It’s a reminder that markets are made of micro stories, where proximity alone doesn’t guarantee the same outcome.

Some homes sell swiftly while others linger, quietly slipping from view. The gap isn’t chance, it’s sellability. Price, presentation, and guidance decide who wins attention early and who stalls. Understanding what makes a home irresistible can turn uncertainty into momentum.

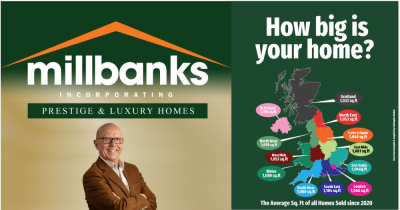

This map highlights the average size of homes sold across the UK since 2020, measured in square feet from completed sales. What stands out is how little the averages vary between regions, despite very different housing types. Northern Ireland is the clear exception, with noticeably larger homes on average.

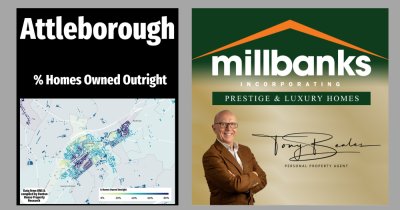

This map reveals how homes in Attleborough are owned, from mortgage-free households to rented areas. These patterns matter because ownership shapes how and why people move, whether driven by lifestyle choices, long-term roots, or changing life stages, offering valuable insight into the local property landscape.

Selling a family home is about more than moving, it’s about managing a transition with clarity, care and confidence. Here’s how to approach your move in early 2026 with less stress and more ease.

If you want to move in 2026, positioning yourself as a serious buyer is essential. Here’s how to put yourself ahead of the competition and be taken seriously by sellers.

With ongoing reforms and rising compliance demands across the UK, managing a rental property alone is becoming increasingly complex. Here’s why professional management now matters more than ever.

If you’re planning to sell in early 2026, now is the time to understand the timeline, the preparation and the steps that will help you move smoothly from listing to completion.

The Autumn Budget brought predictable housing and tax shifts, headlined by a 2028 levy on £2m+ homes that affects under 1% of properties but will shape behaviour for years. Landlords face tighter margins as taxes rise, while Attleborough’s market absorbs uncertainty. The measures add clarity rather than comfort as pressures build.

A new £2m-plus home surcharge is billed as progressive, but its impact falls mainly on London and the South East, where many owners now face an annual bill from 2028. Critics warn it punishes long-term residents, cools the prime market and deepens regional divides, even as households weigh downsizing. Many fear a new cliff edge at £2m too.