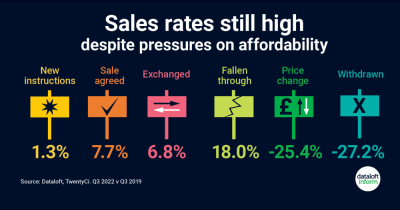

The proportion of properties seeing a reduction is only slightly up on pre-pandemic levels, though a slowdown in activity from last year's frenetic market has led more sellers to be willing to reduce their asking price to agree a quicker sale!

In this quick read we look closely at the property market stats prior to the impact of higher interest rates and inflation in Q3

In this two-minute read, we look at rent protection insurance in detail to help you decide whether you need it.

December is arguably the most expensive month of the year, and as it approaches, many people will be looking for ways to cut down on costs and free up some room for their gift budgets. With the cost-of-living crisis looming over Britain, homeowners are quickly becoming more aware of ways to cut down on their energy usage, here are our top tips:

What if Attleborough house prices do drop? Then, surely, it’s going to be wise to wait and save lots of money? But what if I told you that for most Attleborough homebuyers, waiting could end up costing them a lot more money than what they would save on their purchase price! This is the question many people are asking right now, and the answer dep

Over the years, social media has become a major part of our daily lives. We post status updates, like pics, create videos and reels, learn hacks to clean or decorate our homes… the list is endless.

Homebuyers are heavily influenced by what they see, smell and hear, so here’s a guide to ensuring your property appeals to their senses.

In this quick read we look at the importance of community when it comes to deciding on where to live

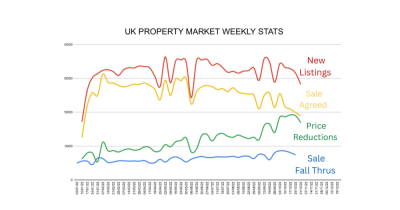

These statistics illustrate that the property market is slowing down however, this was the same picture in November 2021 where the drop off occurred in Nov wk3 for the Christmas 🎄 break. This is back to a more normal market although there are certainly challenges ahead. Source: Twenty EA

Rising interest rates, inflation and the cost-of-living crisis will all affect the value of your Attleborough home. Yet what exactly should (and shouldn’t) Rishi and his team be doing to protect your biggest asset – your Attleborough home.

Rising interest rates, inflation and the cost-of-living crisis will all affect the value of your Attleborough home. Yet what exactly should (and shouldn’t) Rishi and his team be doing to protect your biggest asset – your Attleborough home.

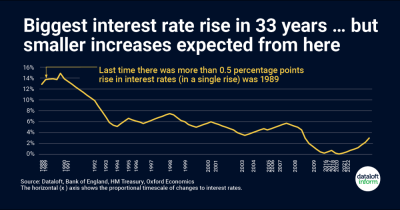

In this speed read we closer at last weeks interest rate rise and what this could mean going forward.