Rising interest rates, inflation and the cost-of-living crisis will all affect the value of your Attleborough home. Yet what exactly should (and shouldn’t) Rishi and his team be doing to protect your biggest asset – your Attleborough home.

Rising interest rates, inflation and the cost-of-living crisis will all affect the value of your Attleborough home. Yet what exactly should (and shouldn’t) Rishi and his team be doing to protect your biggest asset – your Attleborough home.

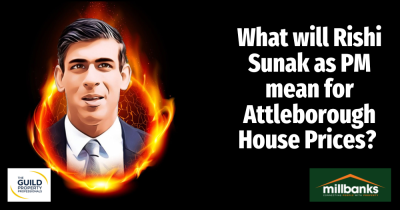

In this speed read we closer at last weeks interest rate rise and what this could mean going forward.

In this quick read, we look at why landlords aren’t always immune to recessions and ways you can protect your rental portfolio.

Click or tap to access our latest FREE Property E-zine and browse out latest new instructions and price reductions

In this speed read, we look at the predicted increase over the next 5-10 years of Build to Rent

Here’s our quick guide on keeping your pooches and other pets safe and sound during the festivities.

If you are a landlord grappling with the prospect of selling a property with tenants, it is important to understand all the ins and outs of the process. Let’s look at everything you need to know if you are considering selling a home with tenants in situ.

A third of all property sales collapse before completion. How can you ensure yours isn’t one of them? Read on to find out.

No Onward Chain and Recently Redecorated Throughout. This 3 Bedroom family home with a Detached Garage is a 'Must See Property' and will attract lots of interest! https://millbanks.web.lifesycle.co.uk/properties/register/buy

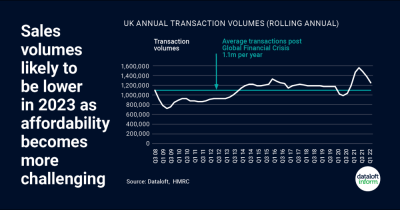

In this quick speed read, we look ahead to the challenges the property market faces in 2023

The economic events of recent months have prompted plenty of to-ing and fro-ing in the housing market. While some buyers and sellers in Attleborough have paused to consider their situations, others have put their foot on the gas to get deals swiftly across the line.